Williams to sponsor bill to protect consumers from credit reporting agencies

UPDATED with comment from Rep. Williams on credit alternatives.

More than 145 million Americans woke up on Sept. 8 to find that their personal data, including Social Security numbers, birth dates, addresses and, in some instances, driver’s license numbers had been stolen through a security breach at the credit reporting agency Equifax.

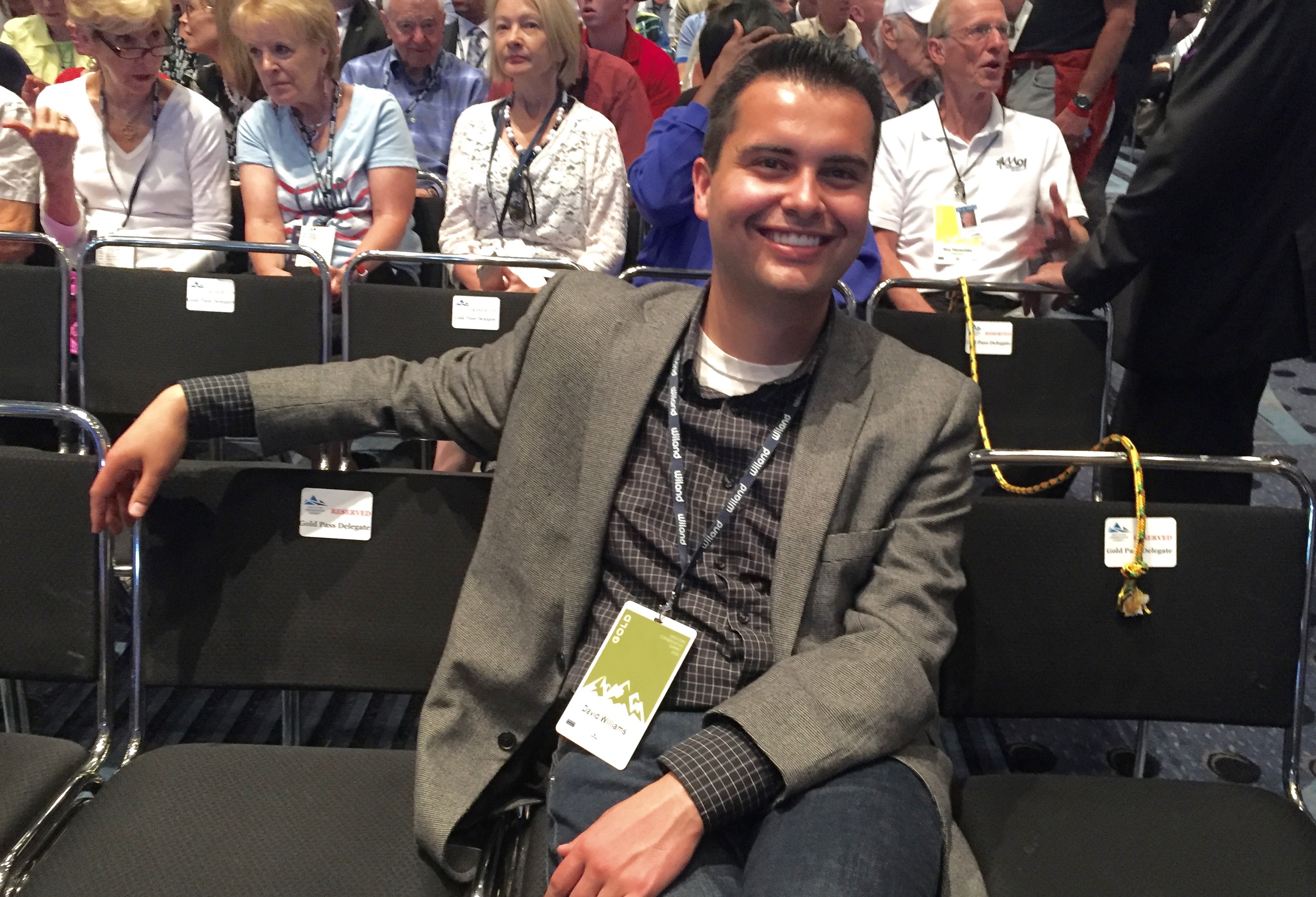

Rep. Dave Williams of Colorado Springs believes the response by credit agencies to the data breaches has been less than satisfying and intends to sponsor a bill in the 2018 session to allow consumers to protect themselves and their financial and personal data.

Republican Williams said Tuesday that the “traditional response from credit agencies when these types of cyber security threats occur has been woefully inadequate to say the least. Equifax was utterly negligent when they allowed cyber criminals to steal the intimate information of over 145 million Americans.”

Williams said his bill would allow victims to control their private information. The bill would also incentivize credit agencies to protect consumers and “uphold their fiduciary reasonability to the individual people they hold immense financial influence over.”

Because of these data breaches, Williams said, “consumers are left with having to deal with cyber criminals and identity thieves for years to come, while Equifax and others continue to profit with little to no relief given to the true victims.”

Under the bill, consumers can “opt out” of a credit agency, which would prevent that agency from selling the information to a third party. The bill also will allow consumers who were victimized in a data breach to hold the agency responsible by requiring the agency to turn over the consumer’s credit file and any other consumer reports the agency has developed on the consumer. The agency would also be required to purge the consumer’s file, both the physical file and the electronic record, and would be prohibited from recording or retaining any information on the affected consumer.

UPDATE: The bill raises questions about credit options for consumers should they opt out of the credit reporting agencies. Williams on Wednesday told Colorado Politics that there are three main credit agencies that banks rely on, and “banks also can look at income and assets versus liabilities like they used to. They can even look at any other criteria they choose.”