Colorado could lose millions in mineral lease revenues under tax bill

Hundreds of Colorado cities, counties and school districts could lose as much as $21 million in mining payments if the Republican Tax Cuts and Jobs Act working its way through Congress passes in its current form.

That’s the claim by the left-leaning Center for American Progress, which last week reported the tax bill would balloon the federal deficit by $1.5 trillion. Among the downsides of that bill, the Center claims, is that Western states could lose $1.3 billion in federal oil, gas, and coal payments.

Those payment are known as federal mineral lease revenues. It works like this: A company leases federal lands for mineral extraction. A share of those lease payments go back to the states in which the lands are located.

In Colorado, those payments go directly to hundreds of cities and counties, and to more than 200 school districts, intended mainly to mitigate the impacts of mining activity.

That’s a big deal for Colorado, where, in 2014, 3.67 million acres of the state’s public lands controlled by the U.S. Bureau of Land Management were leased to energy companies, including oil and gas, coal, solar and hydroelectric operations. In fiscal year 2016-17, those leases produced more than $19 million in payments to more than 400 cities and counties and another $1.7 million to 200 school districts.

But according to the American Progress report, those dollars are now at risk due to something called PAYGO. Under that federal budget law, if Congress passes a bill that isn’t paid for, the federal government is required to enact mandatory budget cuts to cover the cost. The Congressional Budget Office last week issued an analysis that said if the tax bill is enacted, budget cuts to the tune of $136 billion would have to be administered in fiscal year 2018 and continue on for the next 10 years.

In a CBO list published last May on possible budget cuts, $1.5 billion for federal mineral lease payments that go to Western states is included and is listed as mandatory.

The largest share of mineral lease dollars in Colorado go to a half-dozen cities and counties with the most drilling activity. This includes:

-More than $1 million each to Weld, Rio Blanco, Montezuma and Garfield counties. Garfield got the largest check, at $1.9 million. About $1 million also went to the town of Rangely, in Rio Blanco County.

-Two school districts in Garfield County that received more than $160,000 in fiscal year 2017. In addition, Rangely schools got $124,000; Montezuma schools received $145,000. The largest check went to schools in Meeker, in Rio Blanco County, at $172,000.

Luke Shafer of Conservation Colorado said last week that the downturn in the energy markets has made it more difficult financially for many Western Slope communities. Shafer pointed out that in the elections earlier this month, voters approved tax initiatives in almost every Western Slope community that had such measures on the ballot.

“People recognize local governments are in a tough place, financially,” and another hit from losing federal mineral lease dollars won’t help, he said.

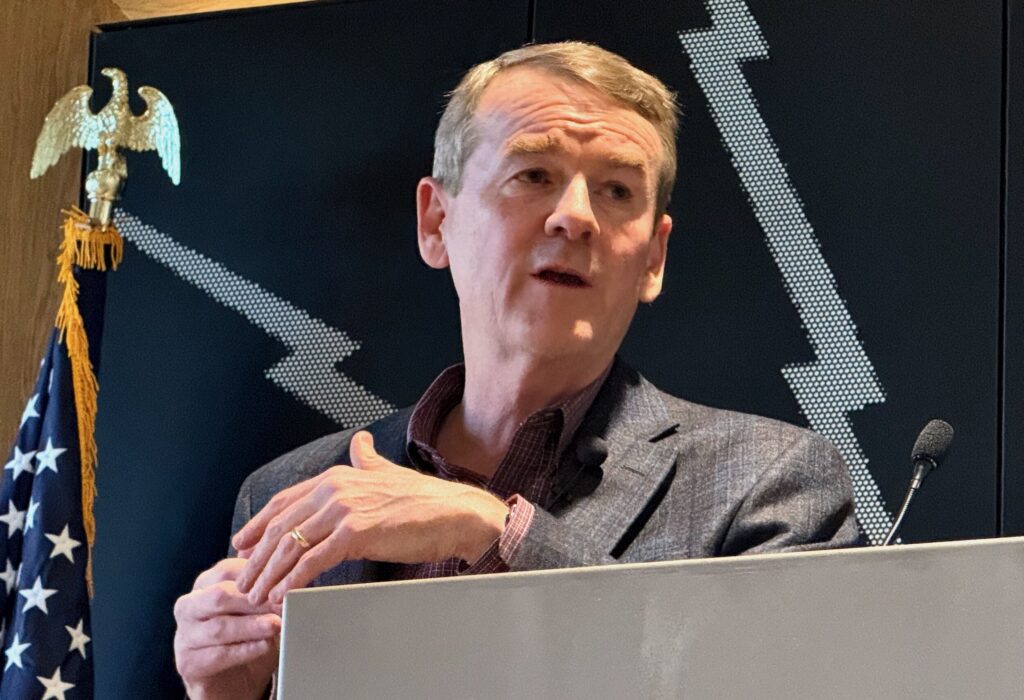

U.S. Rep. Scott Tipton of Cortez was among the four Republicans in Colorado’s House delegation who voted to pass the tax bill on Nov. 15. Thirteen Republicans joined 192 Democrats in voting against; 227 Republicans voted in favor. No Democrats voted for the bill, including Colorado’s three House Democrats.

In a statement issued after the vote, Tipton said the bill will help Coloradans “keep more of the money they earn, grow U.S. jobs and support a globally competitive America.”

“This legislation will put our nation and Colorado back on track by providing much needed assistance to families and small businesses,” Tipton said. “I am especially optimistic as this legislation will bring an estimated 17,520 new jobs to my state and median income households in Colorado are estimated to see an average $3,105 increase in their income. Coloradans know best how to spend their hard earned paychecks and this legislation will allow them that opportunity.”Tipton also pointed out in his statement the bill will help 57,000 small business owners in Colorado’s 3rd Congressional District “keep their doors open and create jobs in their communities.””I recognize that this legislation is not yet perfect, but it is a great starting point,” Tipton said. “The Senate has yet to pass their tax reform bill, and I anticipate that adjustments will be made in the House-Senate conference process.”

Tipton did not return calls for comment on the impact of the tax bill on federal mineral lease payments, where the largest checks are going to schools, cities and counties in his district.