Colorado’s congressmen divided as House committee tweaks tax reform bill

WASHINGTON – Republicans in Congress on Monday began revising the tax reform bill that has split Colorado’s delegation sharply along party lines.

A big reduction in the corporate income tax and other conservative proposals in the bill would be the biggest overhaul of the nation’s tax structure since 1986 and the first major legislative victory for President Donald Trump.

“This budget puts us on a path toward fiscal responsibility and paves the way forward to bring tax relief to hardworking Coloradans,” Colorado U.S. Sen. Cory Gardner said in a statement. “It’s been over 30 years since Congress has passed major tax reform. Over that time, the tax code has become bloated and full of carve-outs for special interests.”

The bill’s proposals for a reduced number of deductions and fewer tax brackets are designed to simplify the filing of income tax returns, which Gardner, a Republican, said would benefit most taxpayers.

“Colorado families know they’re left with the bill and that they spend too much time working through a tangled mess of rules just to file their taxes,” Gardner said. “For individuals, relief would mean we can cut into the six billion hours and $263 billion Americans spend every year to just file their taxes.”

The Republican-dominated House Ways and Means Committee, which is rewriting the tax bill, plans to meet each day through Thursday of this week to discuss revisions.

Grumblings from fellow Republicans about a few provisions in the bill led committee Chairman Kevin Brady, R-Texas, to call for four days of meetings on possible changes before the markup. A markup means the committee has approved it for a final vote in the House of Representatives.

The most controversial portions for Republicans include housing mortgages and small businesses.

The original bill would allow deductions on mortgages as high as $500,000. The Ways and Means Committee is discussing raising the limit to $750,000.

Some Republicans also want changes to the bill’s proposal for “pass-throughs,” which refers to business taxes paid through the owners’ personal returns.

The current pass-through rate is 39.6 percent. The Republican tax reform bill would reduce it to 25 percent.

Some industry groups said the proposed pass-through rate still would be too high to benefit many businesses.

Colorado Rep. Doug Lamborn, R-Colorado Springs, was a big supporter of the tax reform bill even before the Ways and Means Committee started discussing revisions Monday.

He said the proposed tax reforms would revitalize the economy and return more money to the American people.

“Sweeping tax cuts for individuals and businesses will make paychecks bigger and investments longer lasting,” Lamborn said.

However, Colorado’s Democrats said the wealthiest taxpayers would get bigger paychecks while everyone else would see few advantages from the Republican bill.

“It relies on the tired notion that huge giveaways at the top eventually trickle down to everyone else,” Colorado U.S. Sen. Michael Bennet said. “Yet no good evidence supports this.”

He compared the Republican tax bill to what he called the “failed 2012 Kansas tax experiment.”

He was referring to one of the largest income tax cuts in Kansas history that took effect in 2012. It eliminated state taxes for 191,000 small businesses and reduced personal income tax, particularly for the highest earners.

The Kansas governor said the tax cuts would stimulate economic growth and create new jobs. Instead, the state has a growing deficit with lower bond and credit ratings. Unemployment has surpassed national rates since 2012.

“If states are laboratories of democracy, the Kansas experiment was a five-alarm lab fire,” Bennet said. “We must not repeat this failed experiment across the entire country.”

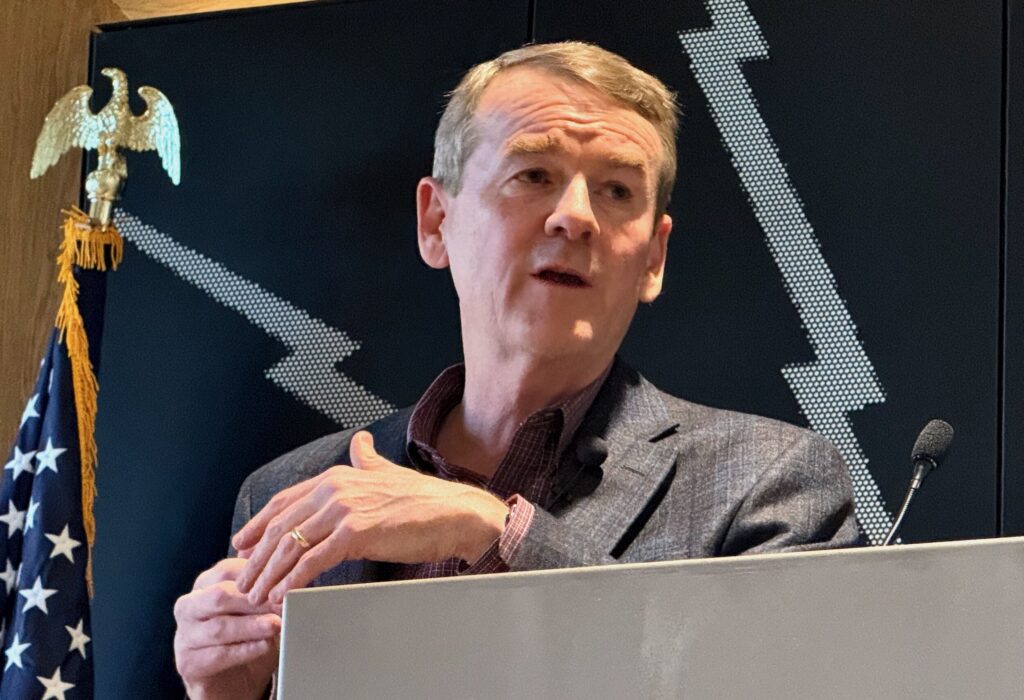

Rep. Diana DeGette, D-Denver, cautioned that Republicans are unlikely to win congressional approval for their tax reform bill unless they are willing to compromise.

“Rather than trying to ram through this one-sided scam, a behemoth of more than 400 pages written behind closed doors that is reportedly being rushed to a vote before Thanksgiving, Republicans should work in good faith with Democrats on real and meaningful tax reform,” DeGette said.

The Ways and Means Committee gave no indication Monday it would revise its plans for the biggest controversy in the bill, namely a drop in the corporate tax rate from 35 percent to 20 percent.

Instead, it worked mostly on tweaking smaller provisions.

Another one of them was a proposal to repeal a deduction for state and local income tax payments. The biggest states would lose significant revenue if the deduction is repealed, which prompted Republicans from California and New York to say they might not support the bill.

The House Ways and Means Committee chairman pledged to finish work on the bill before Thanksgiving.

However, the Senate still is refining its own tax reform bill, which must be reconciled with the House version before it can be sent to the president for his signature.