Why tax reform is key to restoring Colorado’s small towns

Congress and President Trump have recently begun the urgent job of modernizing the country’s outdated and unfair tax system. For Colorado, especially the vast stretches of small towns surrounding our urban centers, the stakes are huge. If Congress can replace the current tax system’s complexities and loopholes with a better system that encourages business and wage growth, all of us will benefit.

The need for tax reform is obvious to everyone who has filled out a personal tax return or started a business. For taxpayers, the current system is complicated and hopelessly confusing. Middle-class taxpayers earning the same amount can pay significantly different income tax levels depending on the tax loopholes they can use.

It speaks volumes that the current head of the IRS testified this year that even he doesn’t prepare his own taxes although he’s a trained tax lawyer. “The code, compared to when I was in law school, is phenomenally more complex and more difficult to understand,” he told Congress.

For businesses, today’s tax rules are a double drag on the economy. They siphon off money that could go toward employee wages and disadvantage our businesses compared with overseas competitors. Tax confusion hits especially hard on small business, which in Colorado accounts for nearly 50 percent of all employees.

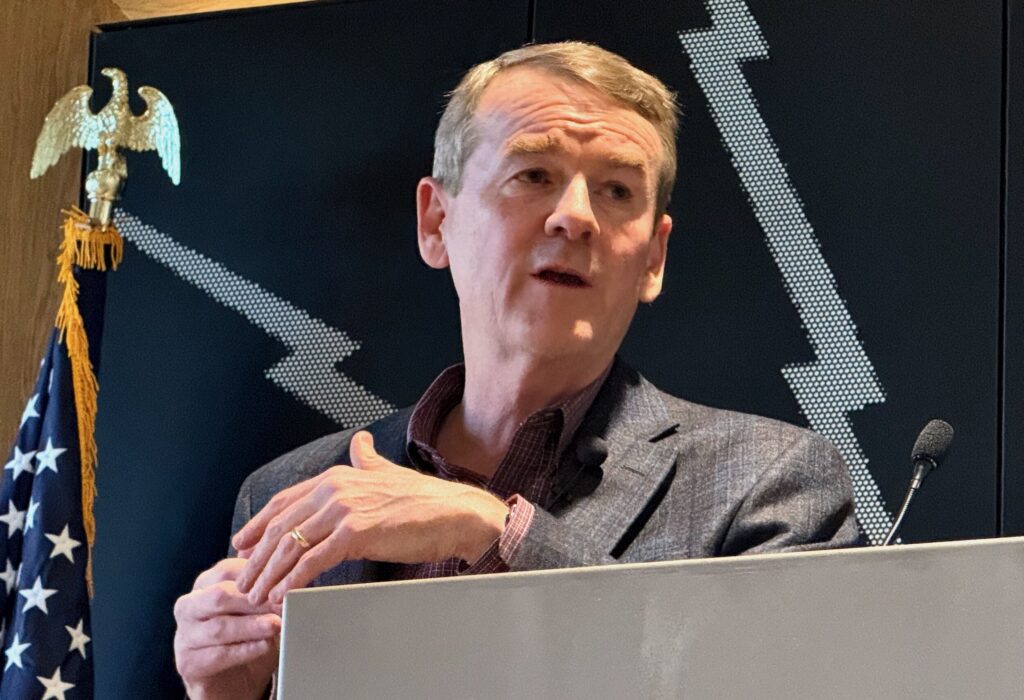

For Colorado’s elected leaders, especially Sen. Mike Bennett who serves on the committee writing the new rules, the best way forward is clear. Congress should create a simplified system that everyone can understand without paying hundreds of dollars.

Business taxes also need reforming. Our business taxes are much higher than in other countries and this undercuts our ability to compete. Just as taxpayers benefit from a simpler set of rules, businesses would be in a better position to grow, develop new opportunities and raise wages if the country had a better tax system.

Tax reform would have enormous benefits for Coloradans living outside the state’s metro areas. About 14 percent of state residents live in small towns, and these areas face major economic challenges. Many of their traditional industries have closed or moved overseas, taking jobs. Even beyond the needs of farmers and ranchers, Colorado needs a tax system that helps these small towns thrive again.

Specifically, since ranching and farming are crucial to many communities, this new system should preserve cash accounting for agriculture. This is a matter of basic fairness as it reflects the tremendous upfront investment that farming and ranching require, coupled with the uncertainties involving the selling price.

The new tax code should benefit small businesses by reducing capital gains burdens on business assets transferred among family members as part of the family business. It should allow mortgage interest deductions for land purchased as part of a farm business.

And finally, the new tax code should repeal the estate tax, which hits especially unfairly on farms and small businesses. A person’s death should not be an excuse for the federal government to upend operations on a family farm, ranch or any other small business.

At stake in this year’s tax reform are benefits for people across this state. Colorado has nearly 600,000 small businesses and the collective benefits of a simplified and fair tax code would increase wages and expand working opportunities.

As a Colorado native (born and raised here) and a member of the Grange for 48 years (including junior Grange years), I see tax reform as much more than just about our state’s farmers and ranchers. It is about the ability of our communities beyond Denver, Aurora and Colorado Springs to build for the future.