Colorado lawmakers seek economic benefits from Republican tax reform proposal

WASHINGTON – Colorado’s lawmakers and business leaders are adding their voices to a controversy over tax reform as Republicans prepare to announce their overhaul plan next week.

Republicans say they need to simplify the tax code for a boost to the nation’s economy and job outlook.

Some Democrats are concerned changing the tax code would help the wealthy but do nothing for low-income and disadvantaged persons.

“In the past few decades, the tax code has grown to a size that is unmanageable and overly complicated,” wrote Rep. Scott Tipton, R-Cortez, in a statement this week.

Tipton is a leading Colorado congressional advocate for tax reform.

He said Americans spend a total of 6 billion hours preparing their tax returns each year as they amass the equivalent of a $409 billion bill to comply with the rules and regulations.

Tipton gave a glimpse of the Republican tax reform plan set to be unveiled next week.

It would seek to simplify the tax code by lowering the small business tax rate to 25 percent, reducing individual tax brackets from seven to three, raising the standard deduction for families and lowering the corporate tax rate to be like other developed nations.

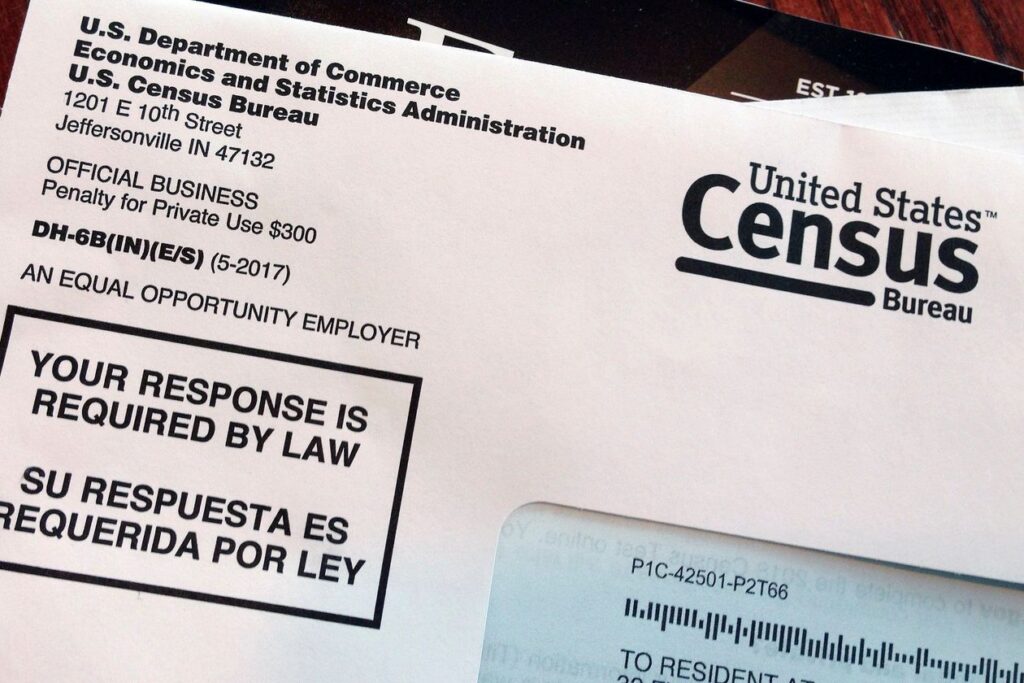

The plan also would restructure the Internal Revenue Service into three units. One unit would be for individuals and families, a second for businesses and a third for a small claims court.

“These changes, combined with the simplification of tax benefits for higher education, charitable giving and savings, will allow Americans to complete their taxes on a form the size of a postcard,” Tipton wrote.

The U.S. tax code was changed most recently in 1986 under the Reagan administration. Since then, Congress has tinkered with the code to make it far different than in 1986, according to advocates for reform.

Small businesses can be taxed as high as 44.6 percent, Tipton said.

“Small businesses support 49 percent of Colorado’s workforce, so reforms that support the small business community are essential for our state,” he wrote.

Rep. Mike Coffman, R-Aurora, said the reforms Congress is considering would encourage American companies that put their money in overseas markets to bring their investments home. He called them “repatriated earnings.”

The current IRS code taxes U.S. corporations twice when they earn money abroad, Coffman told Colorado Politics. First, they are taxed in the foreign countries then a second time when they bring the money back to the United States.

As a result, many keep their investments in foreign countries, depriving the U.S. economy of the benefit of their profits, Coffman said. He recommends eliminating the second tax for repatriating income from abroad.

During a visit last week with the I-70 Coalition, Republican Sen. Cory Gardner said reducing the tax barriers for American companies to bring their money home could trickle down to infrastructure improvements in Colorado.

The I-70 Coalition is a Frisco-based nonprofit group that advocates improvements to the part of Interstate 70 that runs through Colorado. The Denver Chamber of Commerce has estimated the state misses out on hundreds of millions of dollars each year from congestion and infrastructure limitations on the highway, particularly in the Denver area.

Gardner said removing the tax incentives for corporations to keep their money abroad would quickly return $2 trillion to the U.S. economy. Some portion of it could be used for infrastructure improvements, such as on Interstate 70, he said.

Tax reform is getting broad support from conservative groups nationwide. In Colorado, they include the Colorado Business Roundtable and the Colorado chapter of Americans for Prosperity.

Senate Republicans plan to reveal their tax reform proposal on Monday, Sept. 25. Afterward, the plan will be submitted for discussion and debate in Congress.

President Donald Trump said he would like to get the bill passed this year but other lawmakers say a final vote in Congress is more likely in 2018.

So far, the president is being forced to trim back his own suggestions to win agreement from fellow Republicans. He wanted the top corporate tax rate to be 15 percent but House Speaker Paul Ryan said the low-20s is more likely.

The U.S. corporate tax rate now can run as high as 35 percent.

Democratic leaders in Congress are warning they will oppose Republican tax reform proposals that provide a windfall for wealthy persons but provide no advantage for middle and low-income households.