Speaker Duran says transportation funding must be tied to education

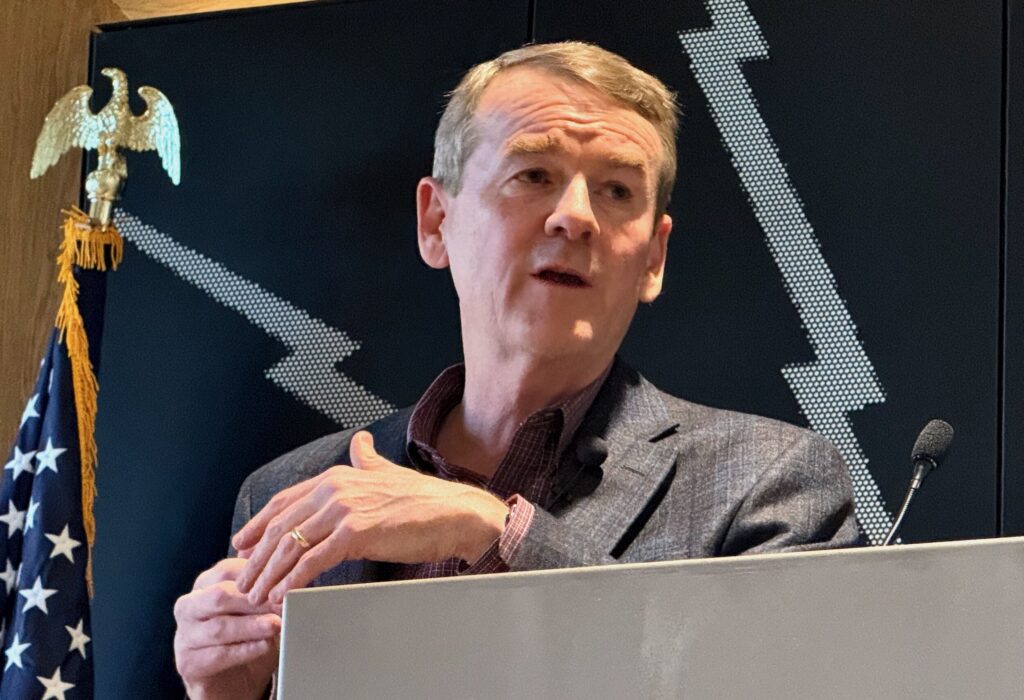

House Speaker Crisanta Duran on Wednesday broadened negotiations around transportation funding by challenging Republicans to support a solution that also protects schools.

The Democratic speaker offered a laundry list of possible solutions, including taking another look at restructuring the Hospital Provider Fee. The proposal has derailed budget talks in the past, and it is believed to be a dead issue again this year.

At a meeting with reporters, Duran departed a bit from earlier comments at the start of the legislative session, when she said a Hospital Provider Fee solution is not practical because Republicans say it is a nonstarter. The proposal would restructure the fee into an enterprise fund, or government-owned business, to free revenue for spending.

The speaker also widened the framework for transportation funding discussions, which this year have not largely included other budget issues, such as funding for schools. It was mostly considered a standalone issue from other budget matters, though Democrats say the issues are connected.

“We are supportive of continuing to invest money into transportation, but we also cannot have the conversation about investing in transportation without having a real conversation about education funding in this state,” Duran said.

Republicans, who control the Senate, have said that they are open to a tax increase that would be referred to voters, but only if Democrats look for efficiencies, allocate and reprioritize existing resources and reduce or eliminate outdated taxes. Proposals include either a sales or gas tax increase.

Republicans also would like to explore bonding, in which voters would approve a loan for transportation funding that the state would pay back in full.

Both Republicans and Democrats pointed to transportation funding in their opening day remarks at the start of the session, and Gov. John Hickenlooper, a Democrat, issued a mandate.

Roads and highways face a $9 billion revenue shortfall over the next decade. Both sides of the aisle agree that the state must come up with a solution, but they continue to clash over how. Given the attention placed on transportation at the start of the session, it would be considered a failure for the legislature not to act this year.

The crux of the issue for House Democrats is that only using existing revenue from the general fund for transportation would result in cuts elsewhere. Education has always been an easy target.

In addition to rekindling Hospital Provider Fee discussions, a conversation that is already being championed by Democrats in the Senate, Duran said another idea includes examining a fiscal thicket thanks to conflicting constitutional government spending and restraint laws.

She also pointed to a bipartisan effort that would tie the state’s spending cap formula in the Taxpayer’s Bill of Rights to personal income, rather than consumer inflation plus population change. The move would allow government to grow when economic times are good.

Despite two Republicans sponsoring the TABOR proposal, Republican leadership has expressed strong skepticism.

Duran also proposed reforming the state’s tax code.

Earlier this week, Senate Republicans reaffirmed that a solution for transportation funding needs to include existing revenue. Tying negotiations to a broader spending and revenue discussion could complicate talks.

“I’ve said before, if Speaker (Crisanta) Duran or House Democrats think a sales tax increase is a standalone solution … that probably doesn’t have a very good chance in the Senate. If it means existing revenues … I am doubtful that has a very favorable view in House Finance,” said Senate Republican Leader Chris Holbert of Parker. “Is there a way to thread the needle, come to a compromise? I hope so.”

But Democrats are hopeful given that Republicans are discussing the possibility of a tax increase, albeit with many caveats, some of which would move the conversation back to a revenue neutral proposal.

Duran turned her attention to tying education to transportation funding in light of the fact that the state must fill a more than $135 million school funding hole triggered by the constitutional Gallagher amendment, which divides the state’s total property tax burden between residential and commercial property.

Because residential values have grown faster than commercial values, the residential assessment rate will drop from 7.96 percent to 6.56 percent. Residential tax collections, upon which schools heavily depend, could drop by nearly 18 percent. The state must restore those cuts to local schools.

Meanwhile, budget writers are dealing with trimming about $600 million to balance the budget.

“We are truly at a crossroads right now,” Duran said. “We want to be able to invest in transportation, but that doesn’t mean we put at risk the future of kids in this state.

“What’s the point of going forward with a revenue neutral ballot issue when we have all these needs? We should try and dig deeper.”

Those who have been leading efforts to fund transportation funding say they are not worried about the public back-and-forth that is taking place as negotiations continue.

“This is part of the ugly sausage-making process,” said Sandra Hagen Solin, spokeswoman for Fix Colorado Roads. “In many respects, this issue is very different than we’ve seen in issues in the past. It is going to be a public debate about what the right solution is.”