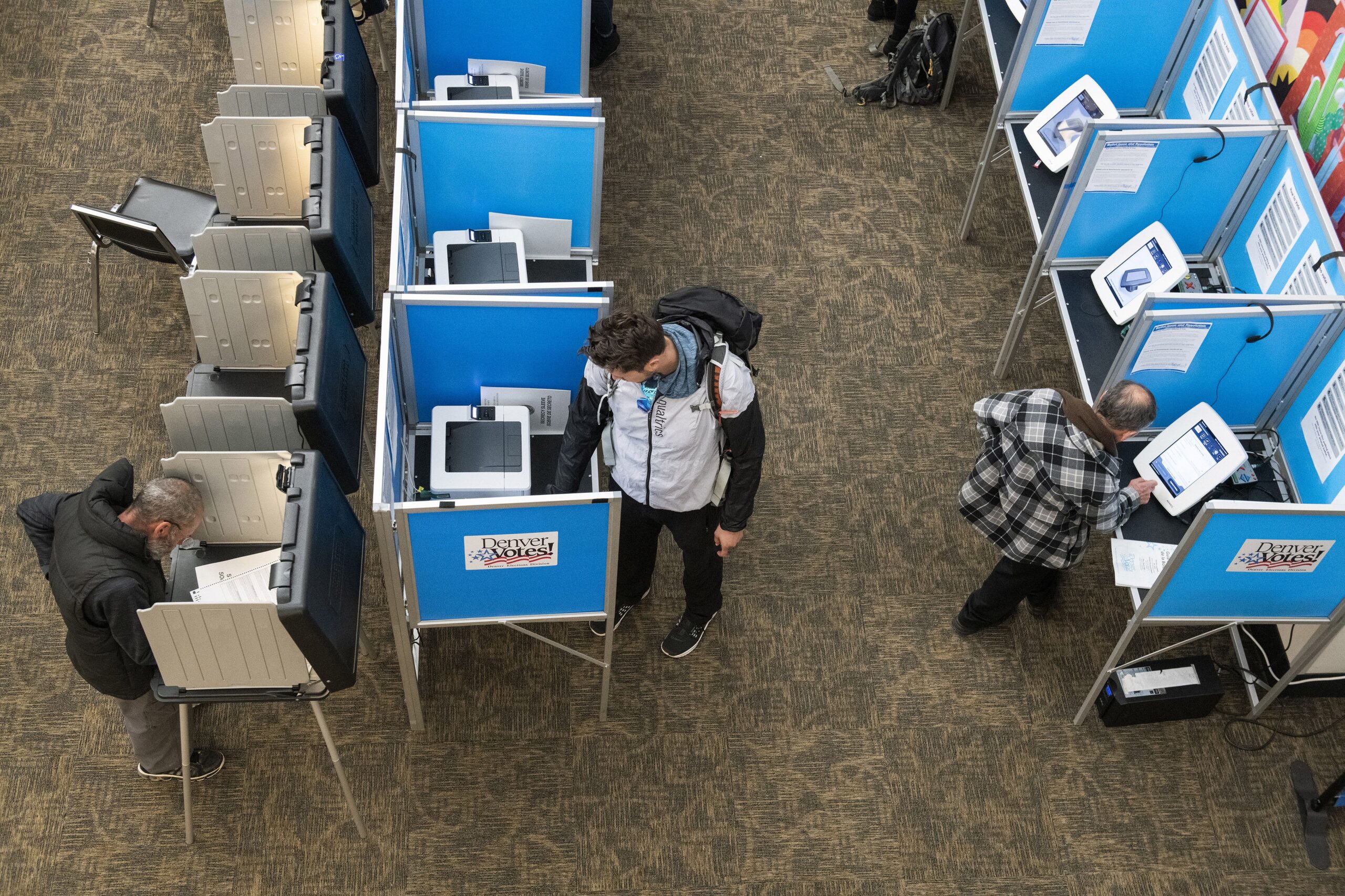

taxpayer’s bill of rights

-

TABOR Derangement Syndrome — Colorado’s ‘TDS’ — is real | Jon Caldara

—

by

In Colorado, TDS doesn’t stand for “Trump Derangement Syndrome.” It stands for “TABOR Derangement Syndrome.” You can spot its sufferers easily. They break into hives at the mere mention of the Taxpayer’s Bill of Rights. In fact, they can’t even utter its full name, Taxpayer’s Bill of Rights, only “TABOR” as if it’s a slur.…

-

TABOR and the Colorado Constitution’s fiscal Gordian Knot | Miller Hudson

—

by

A corporate president advised me once there are two kinds of lawyers: “those who tell you why you can’t do things and those who figure out how to get things done anyway.” He only hired the latter. Since the adoption of the TABOR amendment in 1992, the Colorado legislature has opted for counsel from the…

-

Colorado title board OKs ballot measures to eliminate flat income tax in favor of graduated brackets

—

by

Proponents hoping to change Colorado’s income tax structure from a flat rate to graduated tiers — thereby raising taxes for some brackets — walked away from a Wednesday meeting with eight ballot measures approved by the title board. The coalition backing the graduated income tax change now must pick which one to move onto the…

-

Colorado Supreme Court ponders whether Lakewood violated TABOR in expanding phone provider tax

—

by

Members of the Colorado Supreme Court considered on Tuesday whether Lakewood violated the state constitution by expanding the scope of a 1969 tax ordinance twice in the last three decades to encompass cell phone providers — but without holding a popular vote. A Jefferson County judge believed the city’s actions failed to comply with the 1992…

-

2021 transportation bill did not violate TABOR, appeals court rules

—

by

Colorado’s second-highest court rejected a legal challenge on Thursday to a major piece of a 2021 law that created new funding sources for the state’s transportation system. Americans for Prosperity, a conservative Virginia-based advocacy group with a chapter in Colorado, sought to strike down Senate Bill 260 and block various government-owned business from collecting fees until voters…

-

Colorado Democratic Party endorses Polis’ property tax measure

—

by

Colorado Democrats officially backed both of the ballot measures that voters will face this November. The Colorado Democratic Party’s state central committee voted on Thursday to endorse Proposition HH and Proposition II. The two measures, referred to the ballot by the state legislature, are the only statewide issues up for consideration in the upcoming election. “Colorado Democrats are…

-

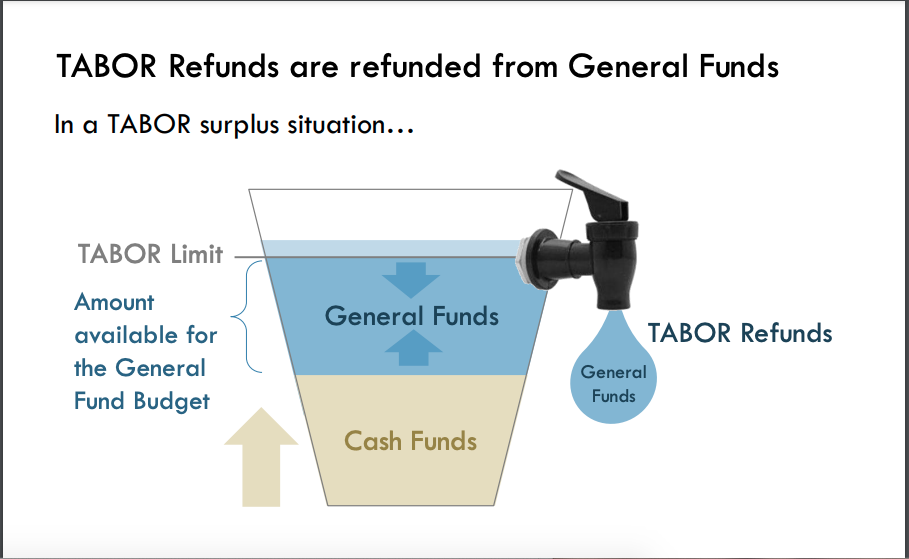

New IRS guidance could potentially tax Colorado’s TABOR refunds

—

by

Only six months ago, Coloradans breathed a sigh of relief when the Internal Revenue Service announced it would not take out federal taxes on refunds from Colorado’s Taxpayer’s Bill of Rights. But now Colorado officials worry that taxability of the refunds is once again being called into question under new guidance released by the IRS on Wednesday,…

-

Conservative groups form coalition against reducing TABOR refunds

—

by

A dozen conservative organizations formed a coalition Thursday to advocate against legislative efforts to reduce refunds from the Taxpayer’s Bill of Rights. This announcement comes one day after Gov. Jared Polis signed a new law asking for voter approval to provide property tax relief by dipping into the TABOR surplus, which pays for the refunds. The groups…

-

Thousands of Coloradans didn’t get $750 refund checks. Here’s what to do if you’re one of them.

—

by

Gov. Jared Polis signed legislation in May to send $750 refund checks to Colorado taxpayers by September – but for thousands of people, those checks never came. Around 3.1 million Colorado residents who filed 2021 state taxes by June 30 were eligible to get $750 for individual tax filers and $1,500 for joint filers from the…