Colorado Lottery Commission proposes credit card sales, sparks controversy

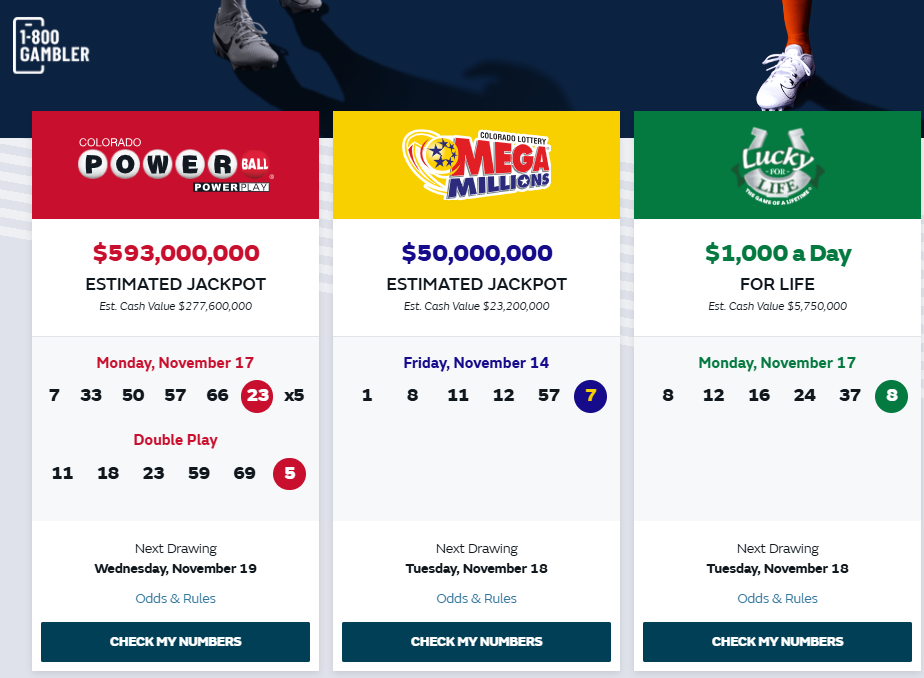

The Colorado Lottery Commission is planning rule changes that are raising eyebrows at the state Capitol, including the prospect of allowing residents to use credit cards to buy lottery tickets.

Within the more than 100 pages of rule changes, most of which are intended to remove repetitive sections and cleanup work, two proposed changes are substantive. The first, if approved, would allow the lottery to sell tickets directly to consumers via the internet, phone, computer or other electronic devices. The second would permit credit cards for payment.

Neither change is going over well with policymakers at the Capitol, where some expressed worries about raising the risk for people with gambling problems.

The new rules are scheduled to be approved by the Lottery Commission at its meeting on Wednesday.

Lawmakers who object to allowing credit card use for lottery tickets are questioning the rules and the process.

Rep. William Lindstedt, D-Broomfield, and Sen. Jeff Bridges, D-Greenwood Village, are among the signatories to a letter telling the commission the legislature ought to have a say in the changes.

Gov. Jared Polis, on the other hand, appears to favor the upcoming rule changes.

A statement from the governor’s office on Monday reiterated how the lottery funds outdoor programs and projects.

“The Governor is supportive of increasing consumer convenience, and the proposed rule change will modernize Colorado’s lottery system and ensure customers don’t need to fumble through several cards to buy what they want or have to pay for some things with a credit card and some with cash,” the office said.

Credit card sales for lottery tickets aren’t new. About 26 states already allow it. Just as many states don’t, including Colorado.

Allowing the lottery to sell directly to consumers is a problem for retailers, who have been selling lottery tickets since the state first offered those games in 1983.

The retail community loves the partnership with the lottery, according to Grier Bailey, executive director of the Colorado Wyoming Petroleum Marketers Association, whose members operate convenience stores that sell 90% of all gas in Colorado and Wyoming. That partnership has been “mutually beneficial for decades,” Bailey said.

The rules changes are likely to have a significant impact on his retailers, said Bailey, who asked why would retailers want to compete against their own government.

That competition comes with a price – via the “interchange” fees retailers collect when they sell lottery tickets, Bailey said. The proposed change would reduce that fee from 5% to 1%.

On top of that, Bailey said, the stores will lose more business to what’s known as couriers, a kind of third-party online seller that can change service fees, ranging from 20 cents to 70 cents per ticket. There are two in Colorado: Jackpocket.com, the largest seller of lottery tickets in the state, and another operated by Lotto.com.

Bailey noted that the courier companies are just now beginning to be incorporated into the upcoming rule changes on Wednesday.

The courier model went into operation in 2019 without any regulation from the lottery commission or any oversight from the legislature. That drew the interest of the state auditor in a 2023 performance review.

The lack of oversight by the legislature also came up in the 2023 state auditor’s report.

It noted the 2014 legislation that prohibited the lottery commission from adopting any rule or policy before July 1, 2017 to authorize ticket purchases by any means other than buying in person at a licensed retailer.

Bailey pointed out that the legislature had granted the lottery broad authority and little oversight beyond a financial audit.

The petroleum marketers’ comments noted a lack of cost-benefit analysis showing the potential decline in retail sales resulting from the rule changes.

Their association also questioned “the societal benefit of continuing the courier model.”

“It is telling that according to the most recent audit report, a small store that sells board games on a wall in Pueblo is the state’s highest seller of lottery tickets,” the group said.

The use of credit cards to buy lottery tickets also troubles the board of the retailers’ association, Bailey said.

In comments to the lottery, the association noted the legislature had removed “cash” as the only way to pay for tickets in 2022 legislation on a lottery grant program.

The change, however, only applied to scratch tickets.

The association said it believed the commission could amend the existing rule without further legislative authority, but “urgently” suggested the commission make a “specific ask to the legislature and governor” for explicit and specific permission to allow for the use of credit cards.

Rep. William Lindstedt, D-Broomfield, who chairs the House Finance Committee, told Colorado Politics he’s opposed to allowing credit card purchases of lottery tickets for a couple of reasons.

First, “it’s a risk for people with problem gambling,” Lindstedt said.

He also pointed out that allowing credit card sales would mean retailers would have to absorb the fees charged by credit card companies, which would diminish their profits on those sales.

Polis’ office said the state lottery body will implement “responsible” gambling tools to assist players in understanding how much money is being spent on lottery behavior. The lottery body is consulting with national experts and other lotteries to ensure best practices are implemented, focusing on player health, protection, and minimizing harm, the office said.

It could even result in retailers losing money.

One analysis said retailers typically pay between 1.3% and 3.5% in interchange, or “swipe” fees, plus a flat fee of 5 to 10 cents per transaction for processing credit card sales. If the interchange fee the lottery pays to retailers were reduced to 1%, retailers would lose money.