Colorado’s Polis and Florida’s DeSantis clash over marijuana tax revenue and black market THC

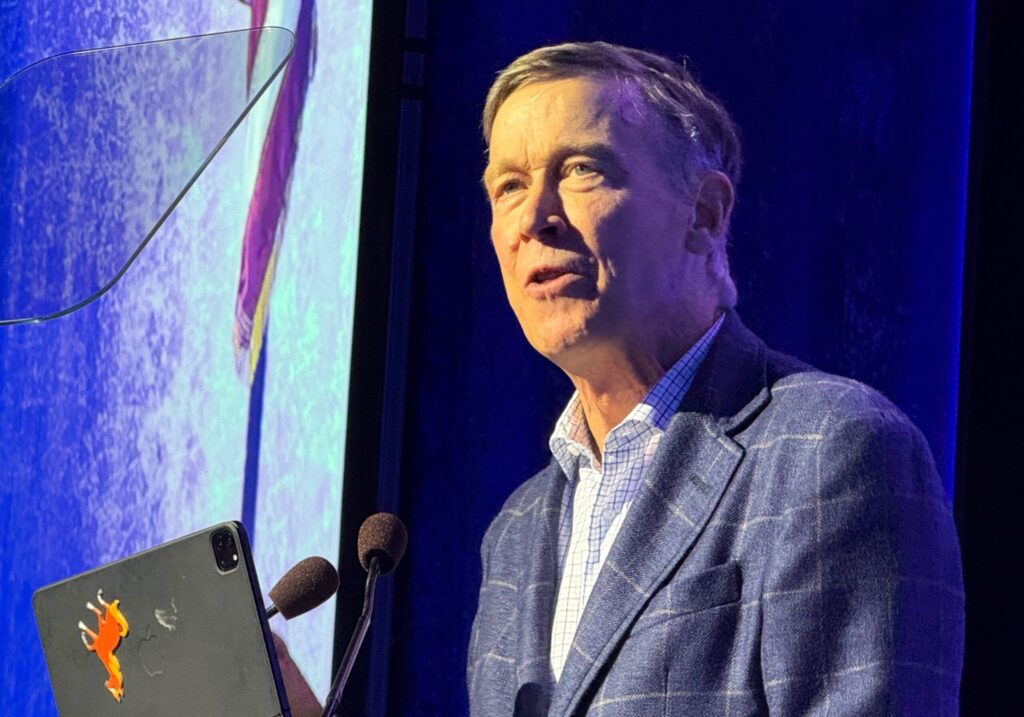

Colorado Gov. Jared Polis exchanged barbs with Florida Gov. Ron DeSantis on social media earlier this week over Colorado’s marijuana tax revenue and THC products in the black market.

The exchange between the Democrat and the Republican comes amid Congress’ surprise inclusion of a near-ban of hemp-derived consumer products in a funding bill passed on Wednesday. That bill ended the longest federal government shutdown in history.

In addition to allocating funding for government operations through the end of January, the bill also contains a provision outlawing nearly all hemp products that contain THC. All six Democrats in Colorado’s congressional delegation voted against the bill, while the four Republicans voted in favor of the deal to end the shutdown.

Polis released a statement the following day criticizing the move, saying he was disappointed to see Congress “leading with fear rather than a vision for the future.”

“Hemp is a symbol of the American spirit, George Washington grew hemp and Betsy Ross sewed some of the first American flags out of Hemp fiber,” he said. “For a party that claims to support business and job growth, they have a funny way of showing it with their continued attempts to stifle growth and innovation.”

The legislation adds various parameters to the definition of hemp, which would prevent “the unregulated sale of intoxicating hemp-based or hemp-derived products, including Delta-8, from being sold online, in gas stations, and corner stores, while preserving non-intoxicating CBD and industrial hemp products,” according to the bill’s summary.

Polis has advocated for hemp since his time in Congress. He co-sponsored the 2018 Farm Bill, which removed hemp from the Controlled Substances Act and legalized commercial production of hemp. As governor, he secured federal approval for Colorado’s Hemp Advancement & Management Plan, making the state one of the first in the nation to regulate the hemp industry by implementing licensing and testing standards and compliance procedures.

Polis has also been an outspoken advocate for the legalization of marijuana, which comes from the same plant species as hemp, but contains more THC and is used for recreational and medical purposes, as opposed to industrial, food and CBD products.

On Nov. 12, DeSantis responded to a tweet about a survey conducted in Florida, in which 90% of respondents said they want the right to vote on marijuana legalization themselves, rather than have lawmakers make the decision.

In response to a comment arguing that legalizing marijuana in the state could eliminate property tax by taxing marijuana, DeSantis wrote “that has not been the experience in Colorado,” adding the Rocky Mountain state’s marijuana tax revenue has “fallen dramatically” in recent years because imposing taxes “makes black market more economical.”

According to the Colorado Department of Revenue’s marijuana tax report, marijuana tax and fee revenue peaked in 2021 at over $400 million and declined after 2022. It stood at roughly $255 million in 2024, about the same as before the pandemic.

In response, Polis noted that Colorado has collected more than $3 billion in marijuana tax revenue since 2014, which has helped pay for roads, schools, recreational centers, “and so much more,” while “successfully cracking down on the underground market.”

“Oh, and we didn’t use $50M in taxpayer dollars to block access to freedom,” Polis added. “But you do you.”

In Colorado, medical marijuana is subject to a 2.9% sales tax rate, while recreational marijuana is levied a 15% sales tax from the consumer and a 15% excise tax from the retailer.

According to the Legislative Council, just under 72% of marijuana tax revenue is allocated to the state’s Marijuana Tax Cash Fund, which is required to be used for health care, health education, substance abuse prevention and treatment programs, and law enforcement. An additional 15.56% of marijuana tax revenue goes to the legislature’s General Fund, and about 12.5% is allocated to the State Public School Fund. According to a recent report by Colorado Public Radio, marijuana tax revenue made up just 0.6% of the state’s total budget.