Colorado’s affordable housing efforts gain momentum despite market challenges

Colorado’s housing shortage is improving after reaching its worst point in 2019, but affordability remains a significant barrier to homeownership, according to a new analysis from the state’s Demography Office.

“The State Demography Office’s analysis compares existing housing shortage estimates and offers an estimate with a transparent methodology,” said Kate Watkins, Colorado State Demographer. “By providing objective, reliable data, the analysis aims to support state and local governments, housing providers, and community organizations in understanding the evolution of Colorado’s housing needs and how to better target resources so that they can be most effective.”

According to the analysis, Colorado’s housing market has undergone a “significant transformation” over the past 25 years, driven by population growth outpacing new housing development, resulting in property value increases that have outpaced income growth.

The State Demography Office estimates that about 106,000 housing units were needed as of 2023, the most recent year in which population and housing data were available, to overcome the state’s housing shortfall. That’s down from its peak in 2019, when the state was short about 140,000 units. To prevent the housing shortfall from growing further, the state will need to build over 34,000 new housing units each year for the next decade, excluding second homes and vacation properties.

According to the report, the recent improvements in housing availability are primarily due to slowed population growth and an increase in housing production; between 2020 and 2023, the state built an average of 43,000 housing units each year, reducing the shortfall by a quarter.

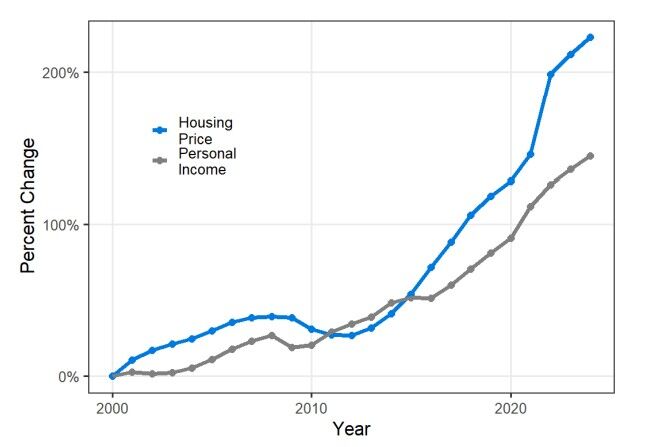

Despite the positive trend for housing availability, Coloradans’ incomes haven’t been able to keep up with the ever-rising cost of housing. Between 2000 and 2023, housing costs in Colorado increased by 223%, while the average per capita income rose by 144% in that same period.

Cost of housing in Colorado versus per capita personal income. Source: Federal Housing Finance Agency and U.S. Bureau of Economic Analysis with authors’ calculations

The Demography Office acknowledged that since 2023, the state’s housing market has faced “evolving challenges” such as increased interest rates and rising construction costs due to tariffs, which have led to a slowdown in construction. The Office said it will update its analysis annually as new data becomes available.

The Department of Local Affairs (DOLA), which houses the State Demography Office and is one of several state agencies that work to find affordable housing solutions for Coloradans across the state through its Divisions of Housing and Local Government.

Through a combination of grants, partnerships with local governments and developers, and state funding through the Colorado Affordable Housing Financing Fund established through a ballot measure in 2022, DOLA has implemented a number of measures aimed at increasing access to affordable housing, including expanding modular and manufactured housing, testing AI technology to speed up the building plan review process, and administering state and federal housing vouchers for individuals needing emergency rent assistance.

“We are fighting to lower housing costs and ensure that every Coloradan can realize the dream of becoming a homeowner, but more work needs to be done,” said Gov. Jared Polis. “By expanding housing options, we can lower costs and provide more options for Coloradans to live where we want to live.”