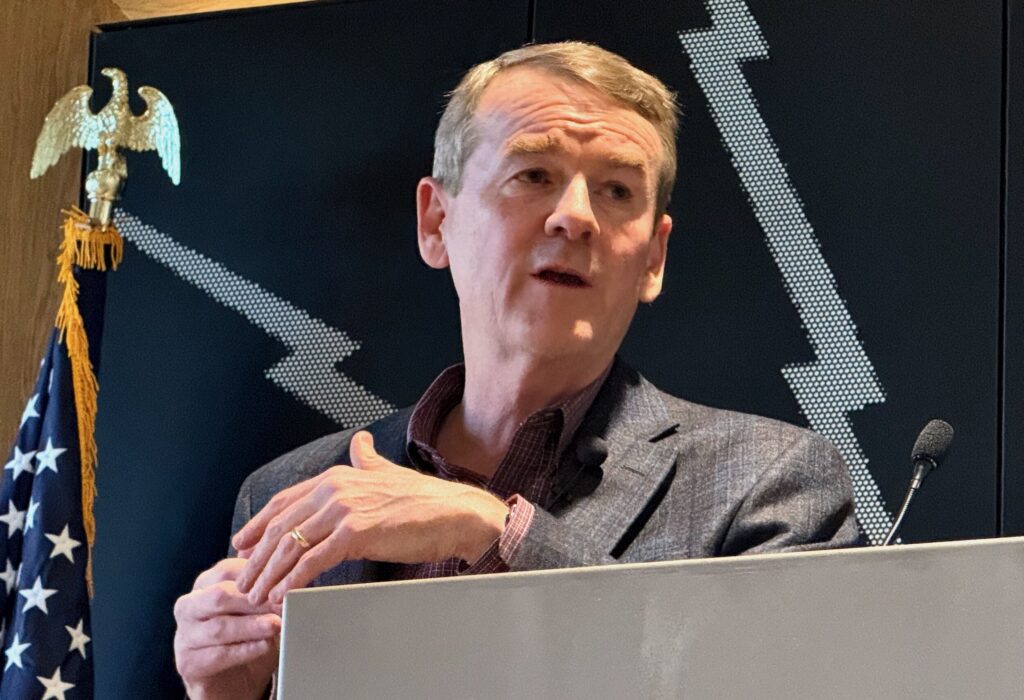

Gov. Jared Polis signs bill to end Colorado’s ‘property tax wars’ — at least for 6 years

Hours after two groups withdrew two ballot measures on property taxes, Gov. Jared Polis fulfilled the last part of the deal by signing into law a compromise measure that is expected to further reduce — but not eliminate — the increases most Coloradans will pay for in property taxes in the next two years.

House Bill 24B-1001 is the result of negotiations among legislative leaders, the governor, Advance Colorado and Colorado Concern, the groups that sponsored Proposition 50 and Proposition 108, which would have cut property taxes deeper than what lawmakers approved earlier this year.

Lawmakers and the governor had feared those two measures would result in a $3 billion hit to the state budget — which is required to backfill reduced property tax revenues to schools, special districts and other local governments that rely on that revenue for services.

The proponents of the two propositions argued the measures were necessary because lawmakers and the governor have failed to provide sufficient, meaningful relief to Coloradans facing massive property tax hikes, as high as 50% in urban counties.

The deal resulted in lawmakers returning to the state Capitol for a four-day special session, the second in less than a year, to deal with the property tax issue.

With the bill’s signing on Wednesday, Polis and lawmakers cheered what they described as the end of the “property tax wars” in Colorado — at least for the next six years.

In addition to withdrawing the measures, the two groups promised not to attempt to push any property tax ballot measures for six years.

Advance Colorado’s Michael Fields said in a statement Wednesday, “Today, Colorado taxpayers are the winners. Our goal over the past two years has been to solve the state’s property tax crisis through a significant and permanent property tax cut and an enforceable cap to prevent future tax spikes. Coloradans across the political spectrum have made it clear that they need substantial and meaningful property tax relief. Today that is what this new law delivers.”

Prior to signing the bill into law, Polis said that lawmakers “heard the voices of the hundreds of thousands of Coloradans who signed” the ballot measures and called for more action on property tax relief.

“This has been the long arc of replacing Gallagher,” he said.

That is a reference to the 1982 Gallagher Amendment, which voters repealed at the legislature’s behest in 2020. Gallagher set a fixed ratio on how much property tax revenue could be collected from residential properties (45%) and commercial properties (55%) — with the legislature required to adjust residential property tax rates to maintain that ratio.

That worked until home values began skyrocketing, and lawmakers had to lower those assessment rates lower and do so every two years. This not only put more property tax pressure on commercial businesses, but it was also devastating to rural Colorado, where home values did not grow as they did on the Front Range. That meant services that rely on those revenues —schools, fire districts, hospitals, libraries, and emergency responders — got squeezed.

Polis pointed out that tenants of commercial buildings will see rent savings based on standard leases that require property taxes to be levied to the tenant as a “pass-through.”

Homeowners and commercial building owners will also see small savings on utility costs. The governor estimated about $100 over five years for residential ratepayers of Xcel, Black Hills, Tri-State Generation & Transmission, and other electric co-ops based on a pass-through that will include filings the utility companies will make to the Public Utilities Commission.

House Speaker Julie McCluskie, D-Dillon, one of the bill’s four sponsors, said, “It was unfortunate that lawmakers had to play defense and provide additional relief because wealthy interests” brought forward the ballot measures.

“I hope this is the end of the conversation on property taxes for the next six years,” she said.

Another sponsor, Sen. Chris Hansen, D-Denver, said the measure creates a clear pathway for improved healthcare, childcare, and higher education funding. He said “this bipartisan compromise” will also protect K-12 funding.

Sen. Barbara Kirkmeyer, R-Weld County, has used the example of a 94-year-old neighbor who lives in a farmhouse but who worried she would not be able to stay in her home because of escalating property taxes.

She is happy now, Kirkmeyer reported on Wednesday.

“The people of Colorado deserve certainty” in their property tax rates,” she said Wednesday. “This bill offers real, tangible results while providing stability” and is the largest property tax cut in state history.

She pointed to the team effort to move the bill through the legislature, even in the wake of trust issues on both sides — meaning the proponents of the ballot measures on one side and the governor and legislature on the other.

“This is not just tax relief,” she said. “It’s a stronger, more stable future for Colorado.”

The measure’s fourth sponsor, House Minority Leader Rose Pugliese, R-Colorado Springs, was unavailable to attend Wednesday’s bill signing but, in a statement, said, “Today we are delivering on a promise of certainty and relief for Colorado.”

House Bill 24B-1001, she said, “provides real property tax relief while ensuring local governments can continue providing essential services.”

“This bipartisan effort will protect our seniors, disabled veterans, and small business owners, offering the stability they deserve,” she added.

Pugliese also thanked everyone who worked on the legislation, adding, “I look forward to continuing to pursue effective property tax solutions for Colorado in the upcoming legislative session.”