Denver school bond likely to join sales tax hikes on ballot

In addition to two sales tax increases that supporters say would generate nearly $200 million, Denver voters could also see a $975 million bond and mill levy package for schools on November’s ballot.

All told, the three proposals, if approved, would result in at least $1.1 billion in additional taxes levied on Denver residents at a time of soaring property valuations and inflation levels that, while not as high as during the pandemic, have yet to go under 2 percent.

So far, only one of the three proposals — the 0.34-point sales tax hike that the Denver City Council said would generate $70 million for Denver Health — has been placed on the ballot.

But a new poll indicated that the nearly $1 billion bond measure that Denver Public Schools is considering would pass. The Denver Public Schools’ Community Planning Advisory Committee had proposed the package back in May. The DPS board has yet to formally approve it.

The proposal comes as the district faces declining enrollment, tighter school budgets, teacher layoffs and likely additional school closures. School funding in Colorado is tied to enrollment.

The poll from Keating Research found that 67% of likely Denver voters favor the bond measure that the school district said would be used to update its aging buildings.

Of those surveyed, 16% oppose the proposal, while 17% are undecided.

Backing for the bond measure is strongest among Democrats (78%) and unaffiliated voters (62%), while a plurality of Republicans (43%) also support it.

The survey, which was conducted June 24-29, included 500 likely voters and had a margin of error of 4.4 percentage points.

The poll’s core question included a lengthy summary of what the new money would pay for, thereby effectively highlighting the benefits of passing the bond measure to respondents.

The summary noted that the revenue would go toward “improving student safety and school security with more secure entrances, weapons detection, and crisis communications technology” and “maintaining and renovating existing school buildings by replacing leaking roofs, making critical structural repairs, and addressing outdated electrical and fire systems.”

It also noted that the money would pay for “providing cooling systems for high-temperature classrooms and schools that lack air conditioning” and “addressing overcrowding and reducing class size by building new schools and expanding capacity in existing schools.”

Crucially, the poll said the proposal does not impose “any new tax”:

“Without imposing any new tax, shall Denver Public Schools debt be increased $975 million with a repayment cost of $1900 million to finance capital improvements of the district …?”

In a news release, Denver Families for Public Schools said it commissioned the survey in order to gain a “firm understanding of voters’ views on this bond investment.”

“This bond is not above the level of previously approved funds, but DPS must still go back to the voters to approve the new debt,” Denver Families CEO Clarence Burton Jr. told the Denver Gazette, explaining why it would not impose “any new taxes.”

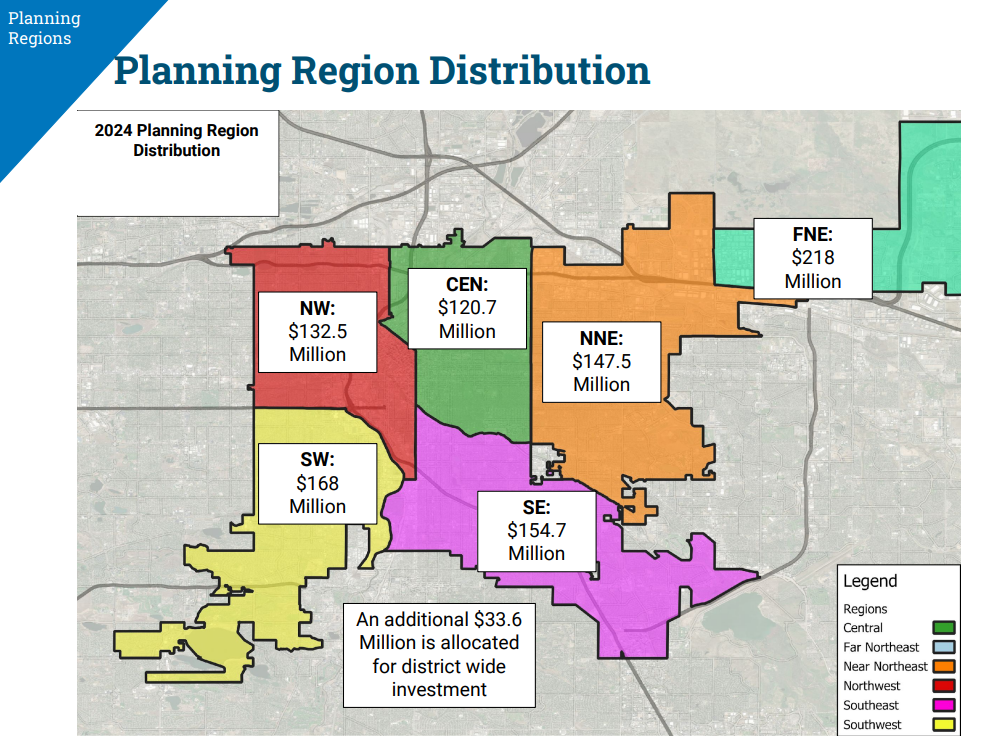

If approved at the ballot box, nearly a third of the bond money would go toward maintenance at 154 schools across the district, and more than $200 million would be allocated for air conditioning and cooling upgrades to 29 schools.

The amount of money allocated at each school for renovations and repairs will vary.

When asked about the disparity of the allocations, Burton listed a couple of reasons.

“The student population is not evenly distributed throughout the city,” said Burton.

Because some projects have already been completed, certain schools may need fewer renovations than others, he said.

The DPS board is scheduled to vote on Aug. 29 whether to put the bond measure on the ballot.

“It shouldn’t be taken for granted that voters are going to continue to approve anything, which is why it was important at this time to do this poll and see where voters were at,” Burton said.

To date, voters have approved $2.3 billion in ballot measures in the past four presidential elections.

These ballot measures have been so successful in Denver that, back in May, Superintendent Alex Marrero joked that he had to keep reminding himself to say “proposed” bond.

Denver Mayor Mike Johnston, who briefly attended the Community Planning Advisory Committee meeting, called the proposal a “big vision for what is possible for Denver.”

“We know that there’s no way you can have a great city without a great school district,” Johnston said.

Arguing $100 million more annually is necessary to build thousands of affordable housing units, Johnston and some of the council’s most progressive members are pushing for a sales tax hike that, if approved by voters, would make the city’s rate the highest in the region.

The proposed 0.5-point tax hike is the second sales tax increase that Denver’s elected officials want voters to approve this November. If voters said yes to both measures, the city’s sales tax rate would become the highest in all of metro Denver and northern Colorado, nearly rivaling the state’s resort towns.

Johnston and several officials said revenue from the tax hike would go toward an affordable housing fund that the mayor hopes would allow the city to double its existing pipeline of new developments. Johnston said existing funding streams will help fund about 20,000 new units. The new tax rate increase could provide $100 million in extra money and fund an additional 20,000 units over 10 years.

And just a few weeks ago, the City Council approved a 0.34-point sales tax hike, sending the measure to the November ballot. The tax, which officials hope would generate $70 million, would help fund Denver Health. Though a small amount compared to the health system’s $1.4 billion budget, councilmembers argued it would inject enough funds to maintain some of Denver Health’s services.

Combined with the 0.5-point tax increase, Denver’s new tax rate would rise to 9.65 percent.

That would make Denver the highest-taxed city in both the metro area and Northern Colorado for sales taxes — it would be higher than Nederland’s 9.435 percent, Commerce City’s 9.25 percent and Boulder’s 9.045 percent.

Denver Gazette reporter Nicole Brambila contributed to this article.