The rocky road for the Global Minimum Tax | SLOAN

It has often been said of Switzerland that it is the best run country in the world, and in many ways it is. Perhaps growing weary of carrying that mantle, or becoming uncomfortable with their success, the Swiss decided by referendum earlier this week to commit their otherwise well-run country to a pair of mistakes: one to adopt a green energy law that purports to cut fossil fuels, another to adopt the Organisation for Economic Cooperation and Development’s (OECD) Global Minimum Corporate Tax structure.

First, it should be pointed out that the measures were approved by a majority of the 42% of Swiss who actually bothered to vote, so one can take that for what it’s worth. As for the energy policy, it is pretty run-of-the-mill stuff. Switzerland imports three quarters of its energy, and all of its oil and gas, which the new law seeks to replace with renewables (though specifically not nuclear power, of course.) Now, that’s not really a great big deal – Switzerland has quite a bit of water, and therefore gets the bulk of its energy from hydropower… except in the winter when most of that water is frozen solid. The Swiss have no more particular desire to shiver in the dark than anyone else, so in due course adjustments will quietly be made to allow the little country to keep buying oil and gas, probably at the same level as it is now (meaning about 2% of its total energy input).

Stay up to speed: Sign-up for daily opinion in your inbox Monday-Friday

The Global Minimum Tax vote may therefore be the more important, but there are indications it may not make it much further than most chimerical green energy fantasies.

Treasury Secretary Janet Yellen has been the prime cheerleader for the OECD’s global tax scheme, which imposes an excess-profits tax on tech and pharmaceutical companies, mainly in the U.S. and the United Kingdom, along with levying a 15% effective minimum corporate tax rate globally. Yellen has been selling the proposal to foreign governments by assuring them the U.S. is on board. The idea is that foreign governments, upon hearing this, would leap at the chance to suck up some additional revenue without having to worry about tax policy competition drawing away investment. Even Britain’s otherwise rather sensible Prime Minister Rishi Sunak was on board.

And indeed, the Biden administration is quite keen on the deal being implemented. It sees the GMT serving as a hedge against the much higher corporate tax rate it wants to impose domestically, and also sees it as a cudgel that will beat Congress into passing those tax hikes.

Only Congress isn’t cooperating. First, implementing the excess-profit tax component would require the U.S. Senate to ratify changes to a plethora of existing tax treaties with several other nations, something it is quite unlikely to do. Second, the GOP-led House launched something of a revolt against what they correctly see as a usurpation of their Constitutionally-assigned duty to levy tax. A bill introduced by the Republicans on the powerful Ways and Means Committee would impose a retaliatory surtax of 5% to 20% on the American earnings of foreign companies domiciled in those countries that signed on to the GMT.

This is not going unnoticed around the world, Switzerland’s plebiscitary mistake notwithstanding. A key member of Parliament within Britain’s ruling Conservative Party, Priti Patel, has initiated her own offensive against her prime minister’s plan to buy into the scheme. Signs are other countries which previously agreed in principle to the GMT are starting to have second thoughts. Even the EU, which is never one to stand on the principle of individual national sovereignty, is giving its members greater flexibility in terms of officially adopting the proposal.

This is all welcome news, as the Global Minimum Tax is problematic on two general fronts: one, it is bad economic policy which will do little more than punish successful American companies for being successful, just to glean a few more dollars from overseas revenue. But perhaps more importantly is the injury and insult done to the concept of national sovereignty. The trend over several decades has been for nations to surrender more and more of their local governing authority to extra-national institutions – the UN, the EU and so forth. Roger Scruton made probably the best case for the natural attachment one feels for their community, as expressed in the nation-state. Republicans in Congress are just as right to be concerned about the GMT usurping American governing authority as the British were when they voted to rid themselves of the EU chains. As much as a discussion about economic policy, the GMT is an examination of what self-government really means, and if we really mean it.

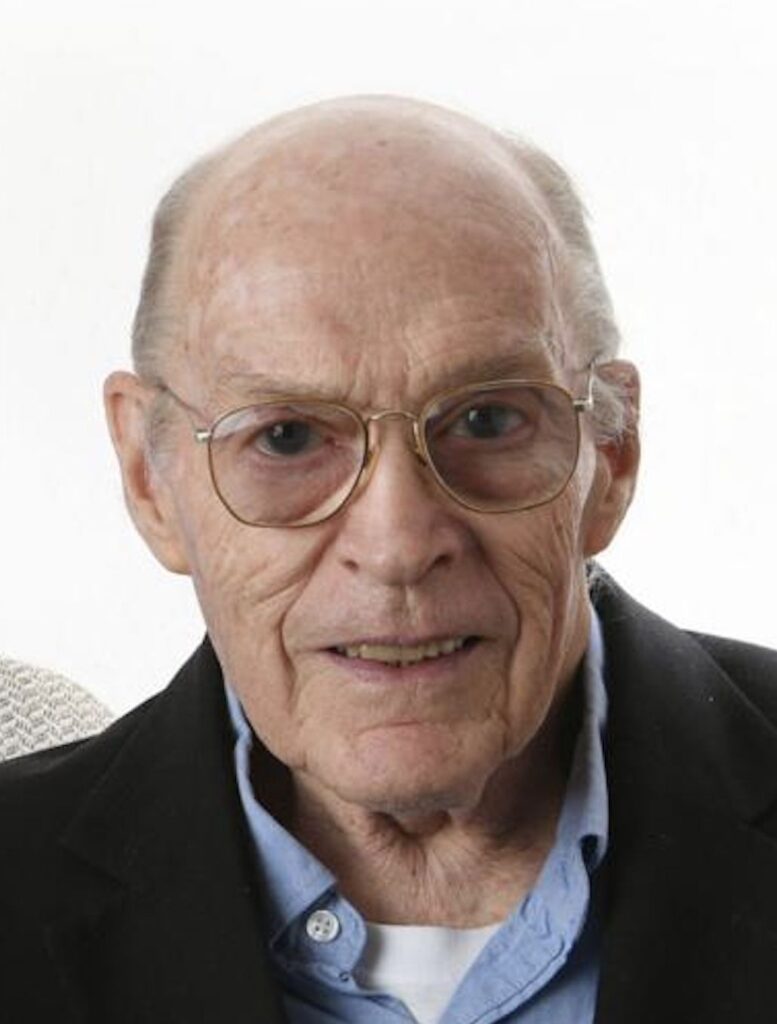

Kelly Sloan is a political and public affairs consultant and a recovering journalist based in Denver.