Colorado credit union’s update of terms, ‘buried’ in email, provided sufficient notice to customers, court says

A Colorado credit union gave sufficient notice to consumers when it announced a change to customers’ legal rights in two sentences at the bottom of an email that required multiple clicks to see the new policy, the Court of Appeals ruled last week.

Although a three-judge panel of the appellate court agreed Ent Credit Union met the legal standard for providing notice, one judge expressed concern that typical online banking customers are not catching important updates inserted in routine account messages – and financial institutions know that.

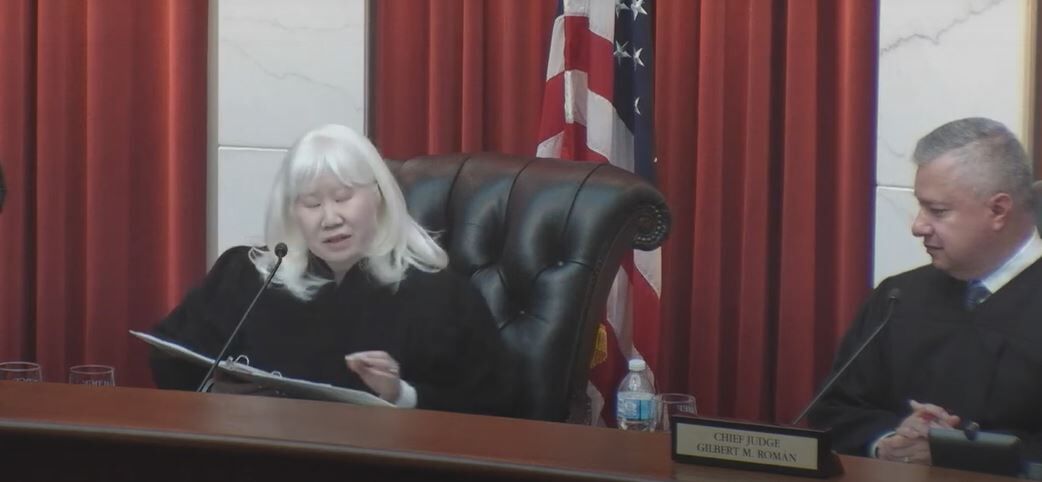

“Would it be too cynical of me to think that banking institutions have done their own market research in this area,” wrote Judge Sueanna P. Johnson, “and are well aware that consumers are not opening their monthly bank statement email, and that they insert the hyperlink with updated terms and conditions knowing that most users will not perceive the email to contain other important information?”

She suggested an update to the law to prohibit financial institutions from alerting consumers to terms and conditions changes in otherwise innocuous emails concerning monthly bank statements.

Jason Frank, an attorney for plaintiff Cecilia Macasero, agreed with Johnson’s analysis of consumers’ ability to see and comprehend updates to fine-print agreements, but argued the law already requires “reasonably conspicuous” notice.

“All of the points Judge Johnson makes in her opinion demonstrate that this notice was NOT reasonably conspicuous to modern day customers in an online banking world,” Frank wrote.

A spokesperson for Ent declined to comment.

In the underlying case, Macasero sued Ent for breach of contract, alleging it needed to refund fees related to her car loan. Her lawsuit was intended as a class action, encompassing all Ent customers who were owed refunds.

At the time Macasero opened her account in 2014, she agreed to accept “statements, notices, and disclosures” electronically, including changes to the credit union’s terms and conditions.

In 2017, the Republican-led Congress, with a tiebreaking vote from then-Vice President Mike Pence in the U.S. Senate, killed an Obama administration regulation that prevented financial institutions from requiring customers to submit to arbitration in lieu of filing class action lawsuits. Less than two years later, Ent amended its terms and conditions to require arbitration, giving customers 30 days to opt out.

The credit union notified Macasero of the new policy in an email that contained news of her monthly statement at the top, multiple paragraphs about banking accounts for children in the middle, and two sentences at the bottom that simply stated Ent had “updated its Membership and Account Agreement.” There was a hyperlink that required users to click through multiple windows to learn about the arbitration change.

Given that Macasero agreed to receive updates by email, Ent claimed it gave her the required level of notice and she needed to submit to arbitration to resolve her fee dispute, not file a lawsuit.

Denver District Court Judge Marie Avery Moses refused to find Ent’s email gave notice of the arbitration agreement, pointing out the credit union chose “modest and unassuming language” to inform customers of the important change to their rights.

“Simply put, this notice was buried at the bottom of an email, almost as if it was designed to be overlooked by anyone receiving this email,” she wrote.

On appeal, Ent argued Macasero’s agreement to receive electronic updates, coupled with the two-sentence advisement, essentially ended the controversy over whether the email provided enough notice.

“She’s effectively telling the credit union, ‘If you send me the notice electronically, I’m gonna read it.’ If she doesn’t read it, I think Colorado law is clear,” said attorney Stuart M. Richter during oral arguments to the appellate panel. “You can’t bury your head in the sand and say, ‘I didn’t get notice because I didn’t read it.'”

“If it’s that important, why don’t you put it at the top” of the email, asked Johnson.

Judge John Daniel Dailey asked why it was reasonable for customers to click multiple hyperlinks to finally read about the arbitration policy.

“At what point does it become too onerous?” he wondered. “Five clicks? Six clicks? Do you have an obligation to keep clicking to the end however long that end is?”

Ultimately, however, the panel agreed Macasero was on notice of Ent’s policy change. Macasero had agreed to receive updates electronically, the hyperlink to the policy was “blue” and “underlined,” and clicking on the hyperlink led to a page with the phrase “Important Account Information.”

“Contrary to Macasero’s argument, we do not deem the notice as being buried or hidden in Ent’s email, or the surrounding information as cluttering the screen to the extent that a reasonable person would be distracted from the important notice,” wrote Judge Robert D. Hawthorne in the May 4 opinion.

Johnson, while agreeing the law was on Ent’s side, wrote separately. She linked to numerous articles reporting at least 70% of customers use online banking, meaning they can check their account balances without relying solely on monthly statements.

“Therefore, was Macasero acting like a ‘reasonable person’ by not opening her monthly online statement because she is like the majority of Americans, who can – and do – check their bank accounts more frequently,” Johnson asked.

Johnson, who is visually impaired, added that Ent’s placement of the alert at the bottom of its email likely made it more difficult for people with different screen sizes and resolutions to notice it.

“During a strictly paper era, the end user received the same layout and printed material. Not so in the digital era,” she explained. “The farther down the notice of updated terms and conditions is placed, the more likely that people with less screen real estate will not view the entire email, thinking that all the important information was at the top.”

Frank, the lawyer for Macasero, suggested that Colorado lawmakers require an opt-in to mandatoy arbitration agreements, rather than an opt-out.

The case is Macasero v. Ent Credit union.