Initiative approved for 2022 ballot to reduce state income tax rate again

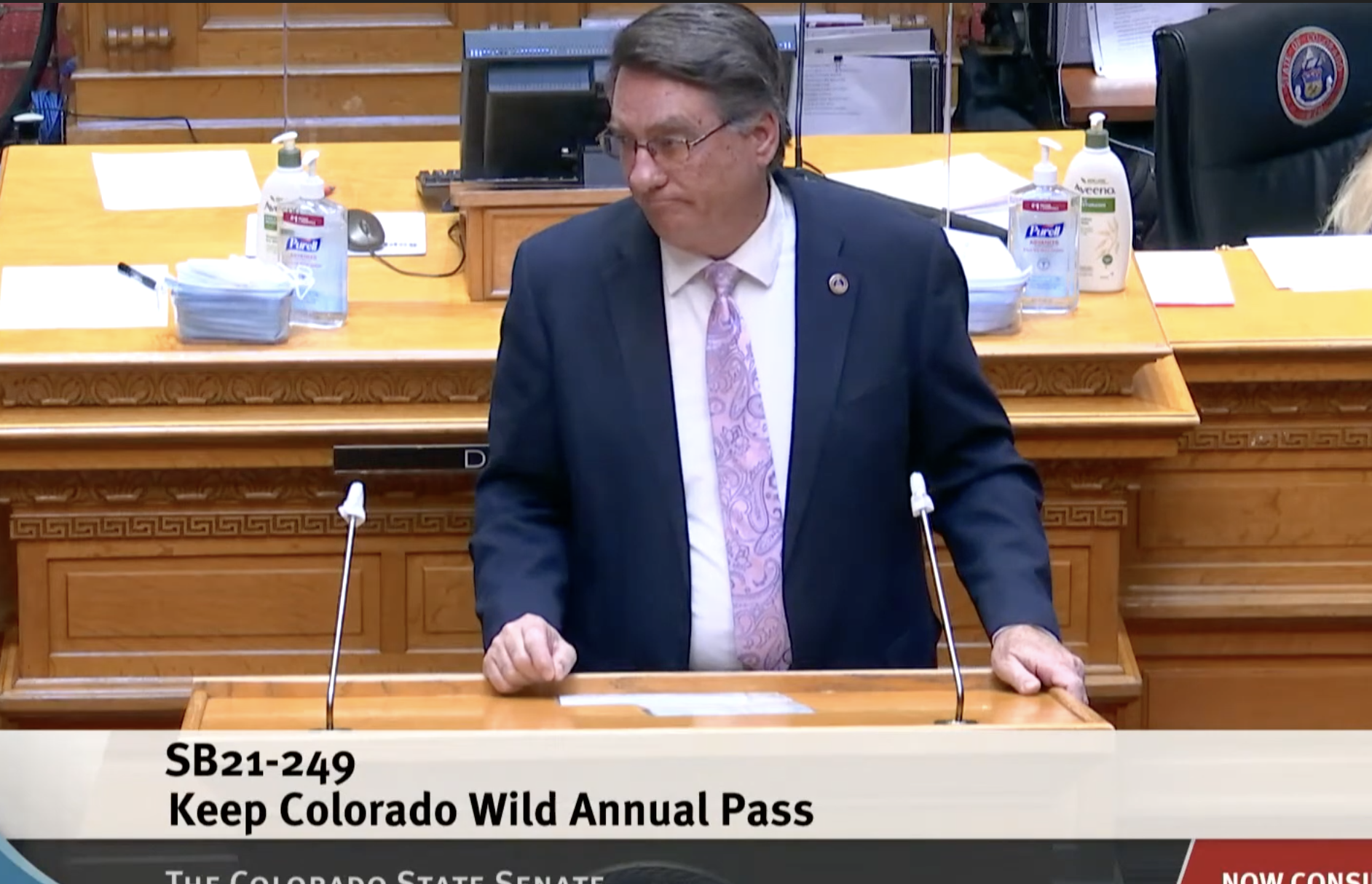

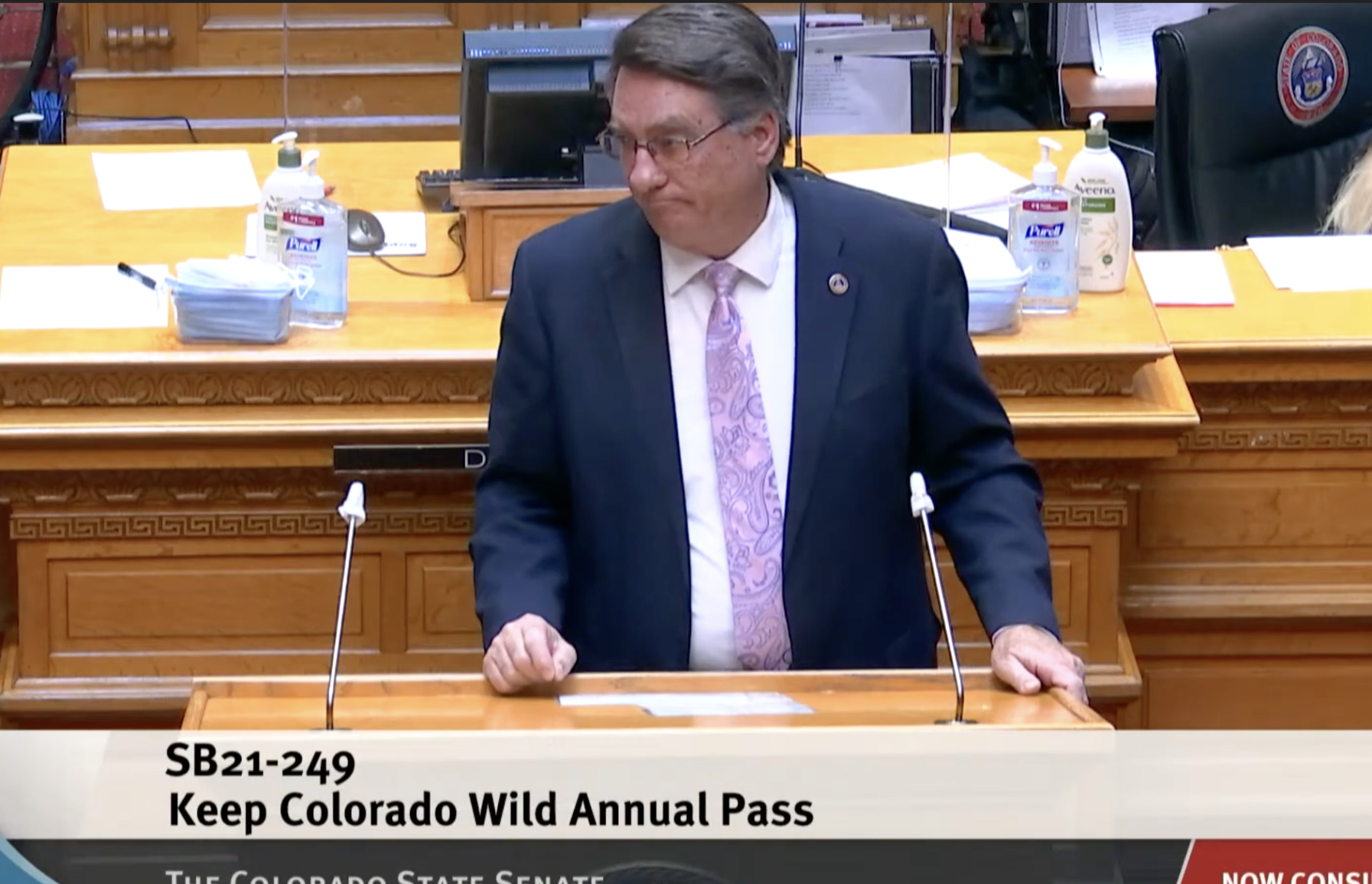

During three out of the last four regular legislative sessions, state Sen. Jerry Sonnenberg has tried to persuade lawmakers to approve a reduction in the state’s income tax.

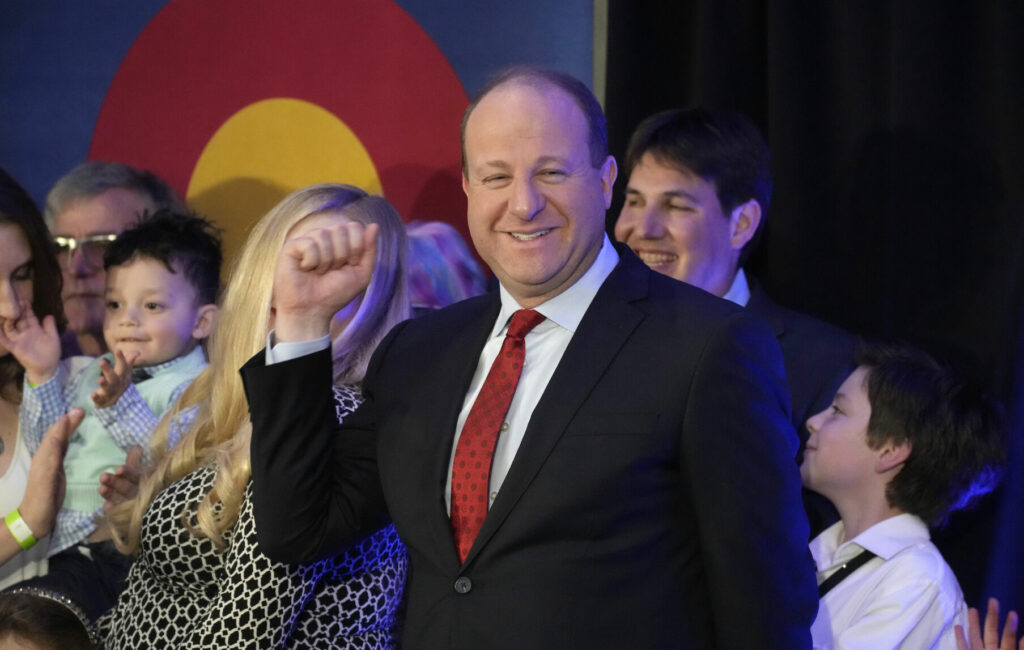

He had hoped in 2019 that Gov. Jared Polis, who has said on several occasions he would support a reduction, would back that effort. But it didn’t happen.

Instead, the Sterling Republican has had much better luck persuading voters to do it. And he’s set to do it again.

Sonnenberg and Jon Caldara, president of the Independence Institute, are the main backers of of a ballot initiative approved Thursday by the Secretary of State’s that would once again cut income tax in Colorado. The pair also teamed up on 2020’s Proposition 116, which reduced the state income tax from 4.63% to 4.55% after being approved by voters approved in 2020 by a 15-point margin. The Legislative Council’s fiscal impact statement estimated state revenues would drop by $230 million in 2020-21 and by $154 million in the current fiscal year.

Initiative #31, the latest proposal from Sonnenberg and Caldara that became the first initiative to reach the 2022 general election ballot, would reduce the state’s income tax rate from 4.55% to 4.4%. The fiscal impact on state revenues is estimated at $530 million in 2022-23 and $370 million in the following year.

The initiative is statutory, so it requires only 50% plus one vote to pass.

Proponents submitted a a total of 215,365 signatures. Based on a random sample of 5% of signatures, the Secretary of State estimated a total of 148,189 valid signatures were submitted. That equates to 118.9% of the required 124,632 valid signatures required to get a petition on the ballot.

Sonnenberg told Colorado Politics he’s excited to again give Colorado residents the option to keep more of their own money.

“While the legislature continues to add on an unprecedented amount of new fees, we probably didn’t lower the income tax rate enough. If government insists on funding their pet projects like Parks and Wildlife through a so-called fee on car registrations, perhaps we should eliminate Colorado’s’ income tax altogether.”

Sonnenberg was referring to Senate Bill 249, the “Keep Colorado Wild” state park pass. The law, which Polis signed in June, adds a fee to most motor vehicle registrations to pay for an annual state park pass. The pass and associated fee are optional and can be declined by the vehicle owner. The amount of the fee is to be determined by state’s Parks and Wildlife Commission and begin no earlier than January 1, 2023.

Currently, an annual state parks pass is $80 and the law says the fee can be no more than half that.