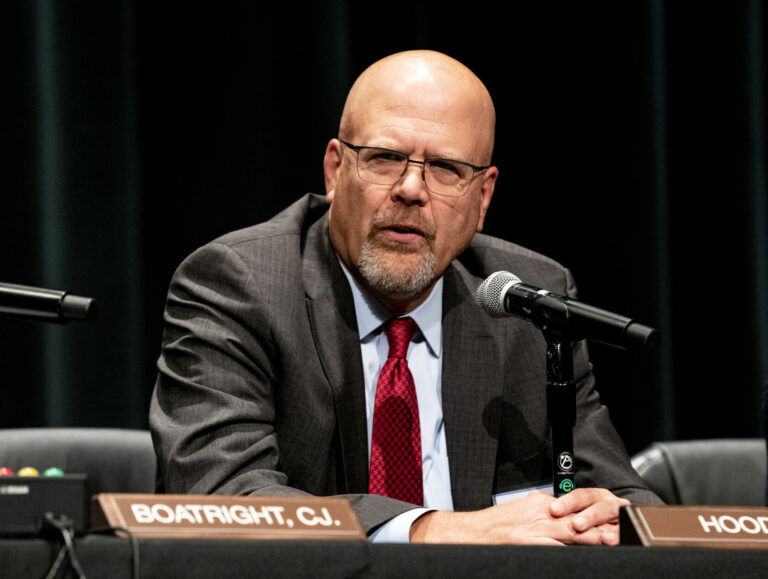

Federal judge believes conflicts of interest ‘did not in any instance’ affect parties

“I should have known that and recused.”

It was a sentiment repeated throughout a 21-page memo that U.S. District Court Judge R. Brooke Jackson sent to The Wall Street Journal last month in response to revelations that he and his wife owned stock in companies that had appeared before him as parties to civil cases. Jackson provided the memo to Colorado Politics upon request.

A bombshell report from the WSJ on Tuesday revealed that 131 federal judges presided over cases despite having investments in a corporate party to the dispute. Jackson was one of two district court judges in Colorado singled out, the other being Senior Judge Lewis T. Babcock, who owned between $15,001 and $50,000 in Comcast stock while participating in a case involving the company.

Jackson examined the 36 cases assigned to him that involved a financial conflict of interest. He acknowledged his error in each instance, while noting that many of the lawsuits involved little to no participation by him. Jackson did not hear, as he put it, the “wake-up call,” even as he took over cases from his colleagues who recused themselves for financial conflicts.

“I hope [I] convinced you that my mistakes were unintended, and that they did not in any instance result in any prejudice to any party,” Jackson wrote in the memo. “In most of the cases I never rendered any substantive ruling, and in those where I did (the homeowner default cases primarily) my rulings were made without knowledge of my or my wife’s stock ownership and were fair rulings based on the law. In each case where there was an appeal my order was affirmed.”

He added that he provided a list of financial conflicts to the clerk’s office on Aug. 16, but that the judge “obviously should have created such a list when I took the bench.”

Under federal law, judges are to recuse themselves in cases where they, their spouse or a minor child who is living with them has a financial interest in the dispute or in one of the parties to the proceedings. The law also does not approve of willful ignorance about investments, advising a judge to “inform himself about his personal and fiduciary financial interests,” as well as those of his immediate family.

Jackson explained in the memo that following his appointment as a Jefferson County trial court judge in 1998, he transferred his 401(k) account to the Bank of New York (now BNY Mellon), where his wife, Liz, also had an investment account. After the move, he said, “I never paid any attention to what was in” the account.

“We receive monthly reports from BONY, of course, but until I received your call I literally never looked at what was in the account,” he told the WSJ. The judge acknowledged his disinterest in financial matters, and that Liz Jackson has handled the judicial disclosure forms for the couple’s accounts. She did not, apparently, know that the judge needed to report a list of financial conflicts of interest to the district court.

“We both thought, she understandably, that by fully disclosing everything in the annual reports we had done what were supposed to do,” Jackson wrote. “At least I can say without reservation that our investments never have, and never could have, affected my handling of any case in any way.”

Colorado Politics reviewed the 36 civil cases in which Jackson had an undeclared financial conflict. As of Wednesday, there had been no additional filings since the WSJ revelations broke. The cases were first filed between 2011, when Jackson joined the federal bench as an Obama administration appointee, and 2018.

In many instances, the cases were resolved or removed to another jurisdiction before Jackson could play a substantial role. Eight similar lawsuits were filed in 2014 against pharmaceutical corporation Pfizer over the cholesterol drug Lipitor. The judge and Liz Jackson owned a “small amount” of Pfizer stock around that time, but the cases were quickly transferred out of state by the judicial panel that handles multidistrict litigation.

The judge also handled two proceedings involving Apple, when he and his wife showed holdings of between $15,001 and $50,000 in company stock. In one of them, a patent infringement case, the plaintiff and Apple settled the dispute between them while the litigation continued against other corporate defendants in a combined case, terminating earlier this year. Jackson acknowledged there was still some Apple stock in his and his Liz Jackson’s accounts while Apple was the defendant, and that the judge should have recused himself.

“Had I known that, I could have denied the motion to consolidate” the cases, he said. That would have meant “the parties would have had to start over with a new judge even though Apple was only in the case for a very short time. But that is what should have happened.”

More problematic, however, were the handful of cases in which other judges had already recused themselves because of their own financial conflicts of interest. Jackson apparently did not connect the dots to his investments.

In one case filed in 2012, two homeowners representing themselves filed a sprawling and difficult-to-decipher lawsuit against Wells Fargo requesting more than $30 million in damages. The case went first to Judge William J. Martínez, who recused himself because reportedly he owned shares in a Wells Fargo affiliate’s mutual funds. After the case landed with Judge Christine M. Arguello, she recused herself for having checking and savings accounts with Wells Fargo.

“My wife and I also had a checking account and a savings account at Wells Fargo, but the key point is that we each owned some Wells Fargo stock at that time in our respective [Bank of New York] accounts,” Jackson said. He eventually dismissed the case after the plaintiffs did not respond to his suggestion to obtain a lawyer or file an amended version of the lawsuit.

Although Jackson made a distinction between cases in which he issued consequential decisions for the lawsuit and instances where he merely performed administrative duties, it is possible for a judge to influence the trajectory of a case without a formal order. In fact, Jackson’s own courtroom practices require that attorneys send letters to him before they file key motions so that he may “evaluate the parties’ positions and determine what the next steps should be.”

Other categories of cases included those in which a magistrate judge had screened the matter first and made a recommendation to Jackson, and cases where a federal appeals court had a chance to review his decisions. In one case that Jackson recognized as particularly unpleasant, he sided with Wells Fargo over a Highlands Ranch couple who allegedly encountered economic hardship and were trying to prevent foreclosure.

The bank “was correct on the law,” Jackson said, adding that he “mistakenly put myself into this position” of ruling for Wells Fargo while his wife owned company stock.

Jackson concluded the memo by asserting he had taken steps to ensure similar conflicts would not happen in the future. As of Sept. 30, Jackson will become a senior judge, a form of retirement that enables him to continue handling cases part-time, which he said will last for at least one year.

“I am embarrassed that I did not properly understand and apply the stock ownership rule,” he wrote. “Being informed of what could be viewed as an ethical violation, even a technical one, is no fun.”

Colorado Politics Must-Reads: