Income tax rate reduction bill clears Senate Finance Committee

Senate Republicans Tuesday championed a bill on tax cuts that would spend down some of the estimated $1 billion revenue surplus expected by state economists in 2018-19.

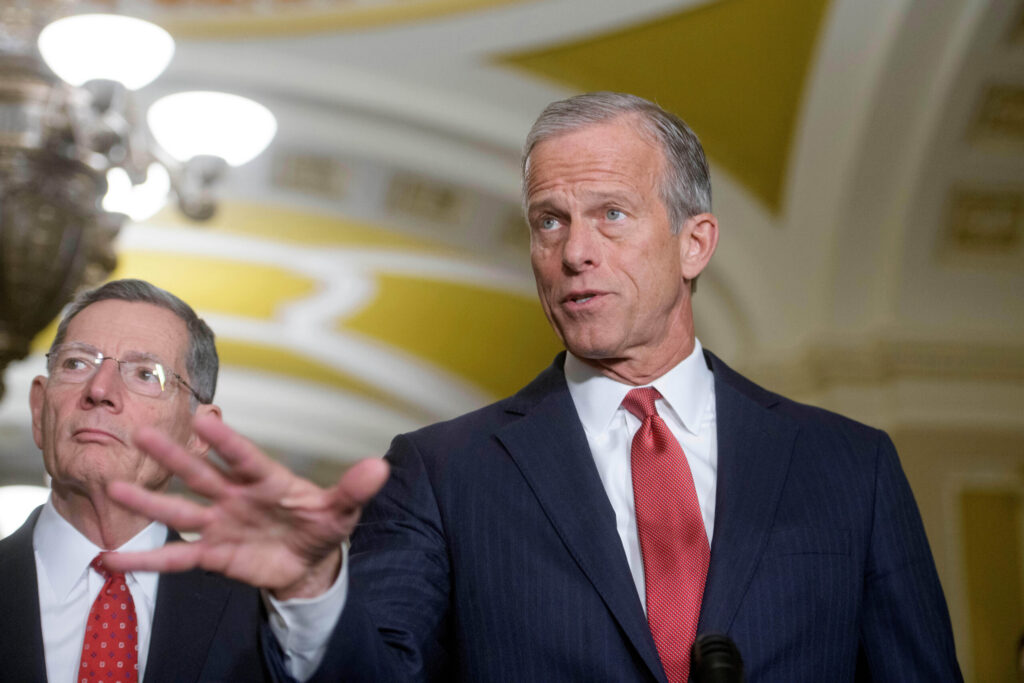

Senate President Kevin Grantham of Cañon City and his number two, Senate President Pro tem Jerry Sonnenberg of Sterling, are the sponsors of Senate Bill 61, which would cut the state’s individual and corporate income tax rate by two-tenths of one percent, from 4.63 percent to 4.43 percent. The bill also would take a similar cut to the alternative minimum tax, beginning Jan. 1, 2019.

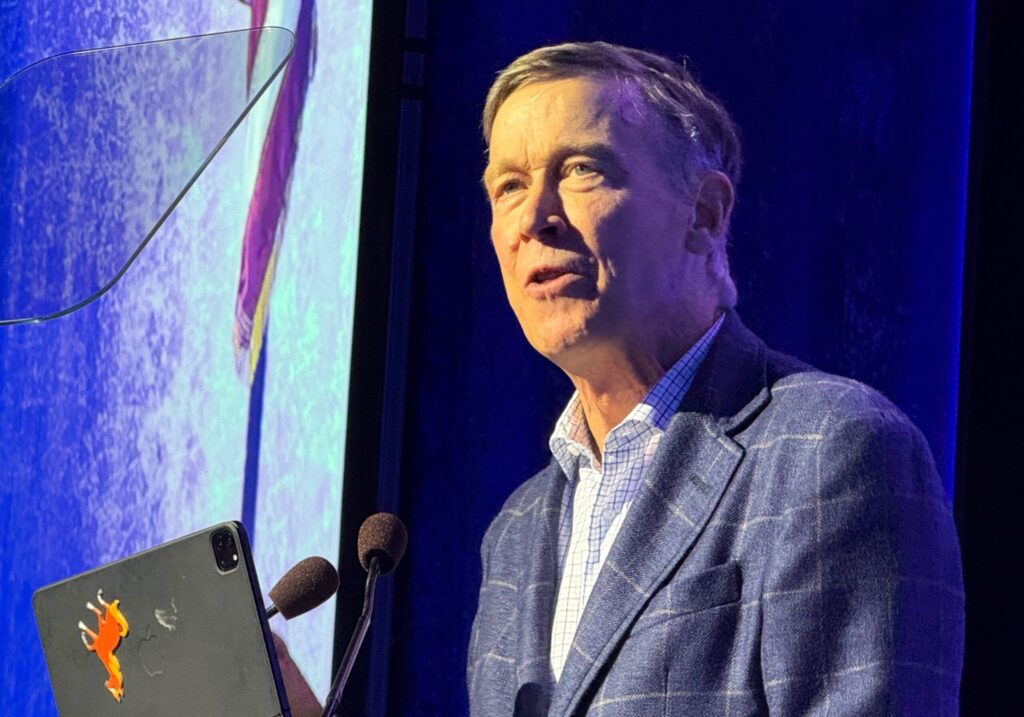

Grantham spoke of the measure in his opening day speech nearly three weeks ago, framing it in part as a response to the governor’s refusal to take an across-the-board 2 percent cut in 2018-19 to state agency budgets, save for transportation and education.

“Last year, Republicans and Democrats in this chamber pushed a bipartisan effort to fund our hospitals, education, and transportation,” Grantham said. “As part of that legislation was a request for a 2 percent reduction in spending for every department except for education and transportation. As we all know, this request was not honored…If this government can’t live up to its guarantees, then we are better giving the money back to Colorado taxpayers.”

That 2 percent reduction request to the governor came through Senate Bill 17-267, the omnibus bill for rural Colorado, which required state agencies to submit budgets showing a 2 percent cut to the governor’s budget team.

The agencies did so, but the bill did not require the governor to adopt those cuts. House Republican leaders filed an open records request just after the session began to find out just exactly how much a cut like that would look like. However, the Hickenlooper administration has so far declined to provide that information, calling it “work product,” which exempts it from the state’s open records law.

Sonnenberg told the Senate Finance Committee Tuesday that the cost of the bill, estimated by a fiscal analysis at $365 million in 2018-19, would be paid for by a $1 billion revenue surplus anticipated by the state in the coming year. That surplus comes in part from higher taxes Coloradans will pay as a result of the federal Tax Cuts and Jobs Act, signed into law in December by President Trump.

“We need to honor what was in 267,” Sonnenberg said. “We need to give that money back to the people, and the way to do it most equitably is through a reduction in the income tax [rate]. Simple enough.”

Sen. Lois Court, a Denver Democrat, pointed out that the surplus isn’t permanent, but those tax cuts would be. “At one point do we recognize government has a purpose and needs to be funded?” she asked. “What will you find to no longer do in perpetuity to make up for the money we will not bring in?” Court also reminded lawmakers that the state still owes K-12 education more than $800 million, dollars cut in the wake of the 2008 recession that has not yet been paid back.

The bill sponsors were warned by tax policy experts during testimony Tuesday that “those who forget the past are condemned to repeat it.”

That’s a nod to what happened in 1999 and 2000 and in two recessions that followed. The General Assembly passed laws in both 1999 and 2000 to reduce the state’s individual and corporate income tax rates and sales tax rates.

But when the first recession hit, in 2002, lawmakers had to scramble to find money to cover the lost revenue, both from the tax cuts and from state revenue declines as a result of the recession. It led to changes in how state employees were paid, a change that has never been corrected, and raids on severance tax cash funds, at about $322 million.

Higher ed took some of the hardest hits in those recessions. The General Assembly ended up reducing state support for public colleges and universities several times, to the tune of hundreds of millions of dollars. To keep the doors open, colleges and universities were allowed to raise tuition, often by double-digit increases; over a decade tuition rose by 80 percent. Colorado has been ranked at or near the bottom in state support for its public colleges and universities ever since. With the cuts in state support to higher education during the great recession of 2008, some have opined that Colorado could eventually become the first state in the nation to completely defund its public higher education system.

Carol Hedges of the Colorado Fiscal Policy Institute gave lawmakers that brief history lesson on the 1999 and 2000 income tax changes. “We don’t have to speculate” about what could happen should SB 61 pass, she said. The state’s general fund budget was cut by 16 percent, which started the downward spiral of support for higher ed, she explained.

“Many of you have not had the experience of governing during real hard times,” Hedges told the committee and the bill sponsors. “It’s tempting to repeat the mistakes” of 1999 and 2000.

But Grantham countered that the money from an income tax cut “has greater use” for taxpayers. As to the recessions of 1999 and 2000, Grantham said not one person he knew back then “shed a single tear that government didn’t have enough money during the recession.”

“Given the choice of making government tighten their belts, or having an extra .2 percent in their pockets, they would have chosen that extra money to spend, not to help the government get through the recession,” Grantham said.

Supporting the bill: Americans for Prosperity and the Colorado chapter of the National Federation of Independent Business. NFIB State Director Tony Gagliardi told the committee that when tax rates decrease, business investment increases. “Investments lead to expansion and job creation,” he said.<

Court acknowledged prior to voting that there is probably waste in government, but not the $400 million envisioned by the bill. Cutting the tax rates back in 1999 and 2000 was a huge mistake, she said.”I will not make the same mistake.”

After the hearing, Sonnenberg denied the bill was at attempt to curry favor with conservatives who criticized his sponsorship of SB 17-267. Sonnenberg is up for re-election to his final Senate term in the fall.

“My people in northeastern Colorado have been supportive of me; my district has been supportive of me” and of 267, he told Colorado Politics. “This is good public policy because we have over a billion dollar estimated surplus. Let’s give it back to the people and let them make the investment.”

SB 61 passed on party-line 3-2 vote and moves on to the Senate Appropriations Committee.

But the lack of bipartisan support could portend trouble if and when the bill gets to the Democratic-controlled House.