Gardner argues for tax reforms proposed by Trump administration

Colorado U.S. Sen. Cory Gardner argued Wednesday in Washington that middle-income families would benefit from a tax cut as the Senate prepares to vote on a preliminary budget proposal this week.

The Trump administration’s tax reform bill is a key part of the budget outline being debated this week.

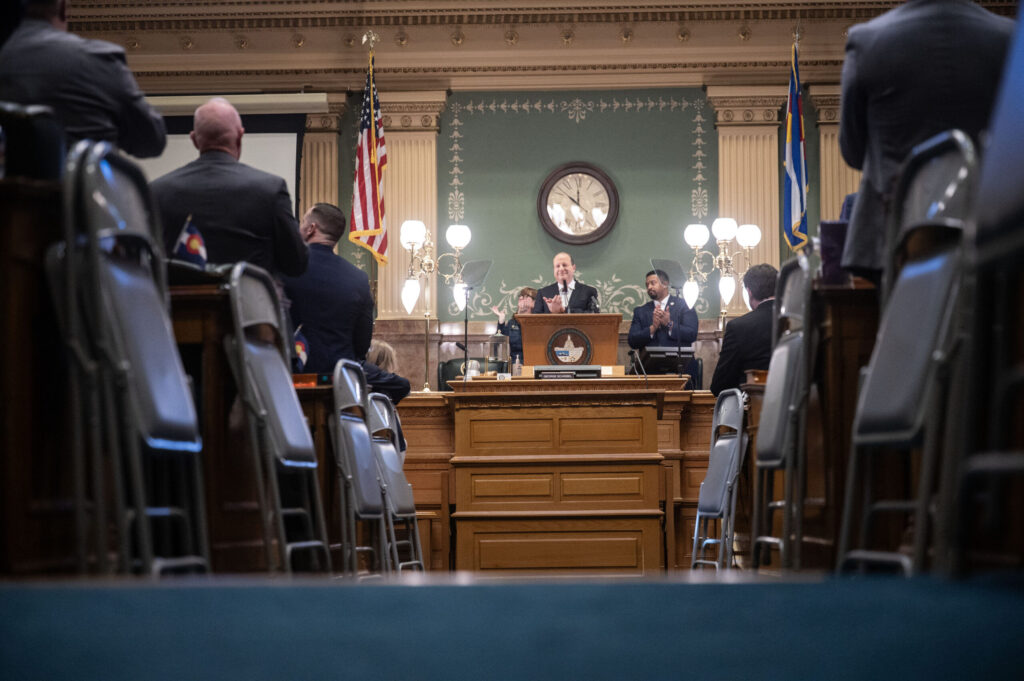

The bill is designed “to create jobs on Main Street, to change this unfair system we have,” Gardner, a Republican, said during a speech on the Senate floor.

Most of his criticism fell on the corporate tax rate, which averages 35 percent in the United States. Republicans propose lowering the average rate to 20 percent.

“We have the highest corporate tax rate in the industrialized world,” Gardner said.

He and other Republican senators are trying to beat a self-imposed deadline to complete the tax reform bill by the end of this year.

However, even President Donald Trump is saying the work is likely to extend into next year.

The Republicans wanted to complete the legislation early to give themselves credibility among voters headed to the 2018 midterm elections.

The budget outline being considered this week would authorize the use of a “budget reconciliation” process between the House and Senate versions of the tax proposals. It would speed up a final vote by avoiding extended debate and possible filibusters.

“It’s the employees that bear the burden of corporate taxes,” Gardner said.

Corporations typically pay their tax bills by keeping wages of workers low, he said.

Many European companies pay taxes only slightly higher than 18 percent, which also impairs the ability of American corporations to compete with them, he said.

The Republican tax reform bill would give middle-income families an average of about $9,000 a year more than they earn under the current tax code, Gardner said.

He also argued in favor of simplified tax returns and elimination of the estate tax, which he said would help farmers and family business owners avoid risks of losing their businesses.

Gardner’s comments evoked denials from Democrats in the U.S. Senate and in Colorado.

“Just like the Bush tax cuts, the Trump tax cuts will be a huge windfall for the rich and a slap in the face to hardworking Coloradans,” Eric Walker, spokesman for the Colorado Democratic Party, told Colorado Politics.

Nonpartisan analysts say the Republican tax reform proposal would raise taxes for 30 percent of middle-class families, he said.

“Even Republican economists are admitting that business tax cuts help CEOs and shareholders but not middle-class families,” Walker said. “Democrats believe that not one penny in tax cuts should go to millionaires and billionaires. We believe the tax code should reward hard work, not just wealth.”

Some Republicans in the Colorado General Assembly believe helping wealthy business owners is not the point of the tax reform bill.

“We need to remember that 99.7 percent of all employers are small business owners and employ nearly half the workforce,” said Rep. Lori Saine, R-Firestone. “If we cut taxes, small business owners will reinvest back into the economy. If we cut taxes, we will also see American jobs come back home.”

Other provisions of the tax reform bill would reduce the number of tax brackets from seven to three, with a 12 percent tax rate for the lowest incomes, 25 percent for middle incomes and 35 percent for the highest tax bracket.

Business income reported on personal returns would be taxed at 25 percent. The standard deduction would double.

The proposal would eliminate the alternative minimum tax, personal exemptions and many itemized deductions, except the ones for mortgage interest and charitable contributions.

The biggest disputes center on whether middle-income families would pay more or less tax.

Treasury Secretary Steven Mnuchin says cutting corporate income tax would benefit workers more than the company owners.

However, the nonpartisan congressional Joint Committee on Taxation reported that owners would benefit more than workers.

The nonprofit public policy foundation Committee for a Responsible Federal Budget said Trump’s tax plan would add more than $2 trillion to the federal debt in the next decade.

Sen. Ed Markey, D-Mass., referred to tax cuts after the Reagan administration’s 1986 tax overhaul when he said, “History has told us that tax cuts do not pay for themselves.”

Markey spoke on the Senate floor Wednesday immediately after Gardner.