tax credit

-

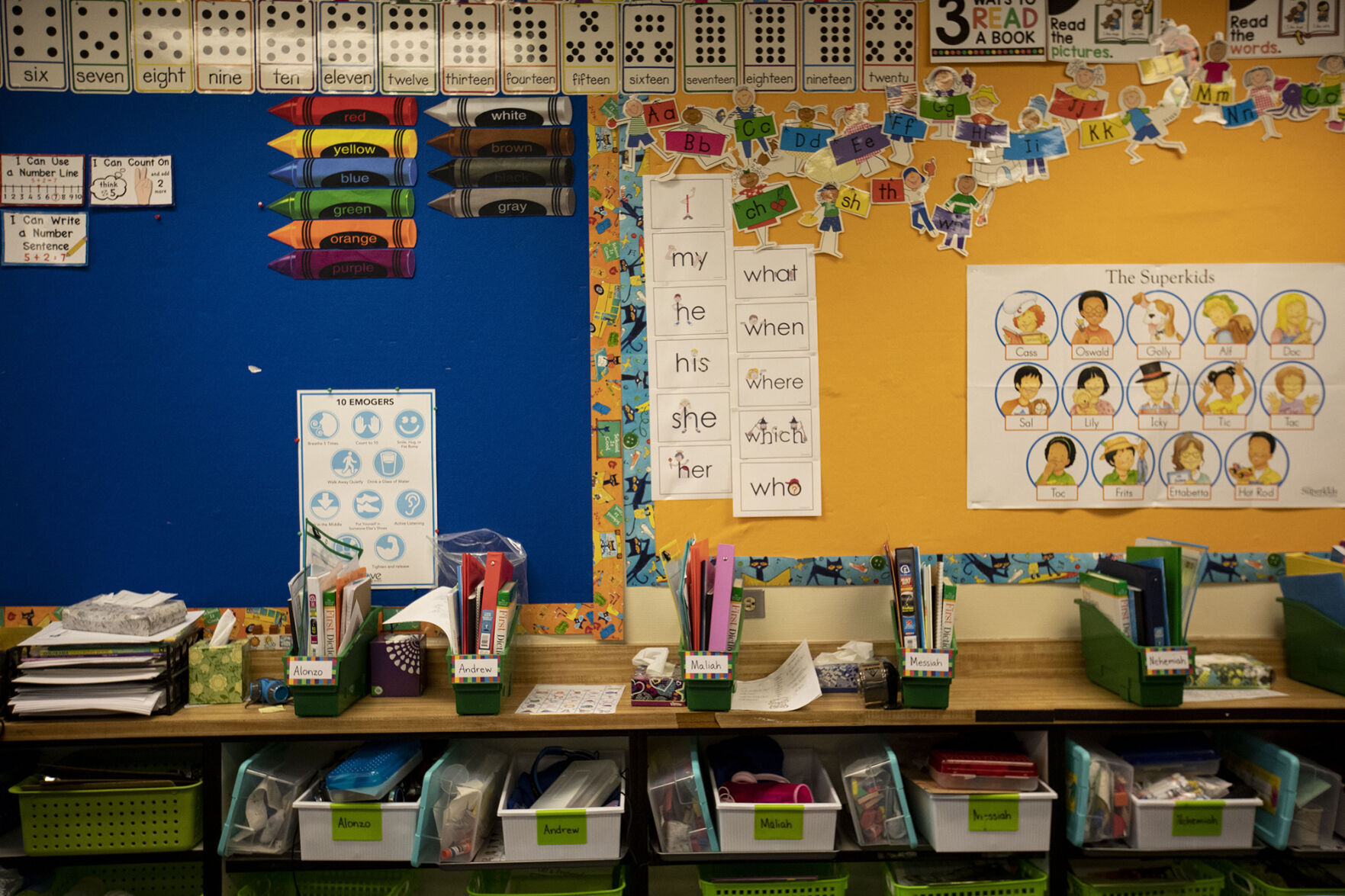

Colorado proposes $1,000 tax credit for teachers to buy classroom supplies

—

by

More than 90% of teachers spend their own money on classroom supplies, according to the National Education Association. In Colorado, lawmakers want to put an end to that practice. If passed into law, House Bill 1208 would reimburse full-time, licensed public school teachers $1,000 each year to pay for school supplies, with a new refundable state income…

-

Colorado to end sales tax for period products, diapers this week

—

by

Coloradans will soon be able to purchase period products and diapers without paying state sales taxes, thanks to a new law taking effect Wednesday. The law, House Bill 1055, expands sales tax exemptions for adult and youth diapers and period products including tampons, pads, menstrual cups, sponges, sanitary napkins and panty liners. Originally, the tax…

-

House committee clears bill extending small business exception from destination sourcing tax law

—

by

The first bill to be acted on in the 2022 General Assembly won a unanimous vote Thursday from the House Business Affairs & Labor Committee and is on the fast-track to the governor’s desk. House Bill 1027, which came out of the interim Sales and Use Tax Simplification Task Force, deals with destination sourcing. That’s a requirement…

-

Gov. Jared Polis announces launch of tax credit to help employee-owned businesses

—

by

Gov. Jared Polis, joined by some of the employee-owners of Hercules Industries in Denver, announced the state’s Office of Economic Development and International Trade will start accepting applications for a new tax credit in the new year. The credit is intended to help Colorado-headquartered businesses that want to convert to an employee ownership model cover…