Colorado property tax ballot initiatives withdrawn as part of deal with governor, lawmakers

Two initiatives aiming to cut property taxes and cap their revenue growth have been officially withdrawn from the Nov. 5 ballot, Colorado election officials confirmed on Wednesday.

The withdrawal was the culmination of a negotiation — among Gov. Jared Polis, legislative leaders and the groups behind the initiatives — that led to a special session last week, when lawmakers approved a deal that reduced the assessment rates for residential and commercial properties and limited the revenue growth for local governments and school districts.

Key to that compromise was the agreement that, if the deal was enacted into law, Advance Colorado and Colorado Concern would withdraw Propositions 50 and 108 from the ballot.

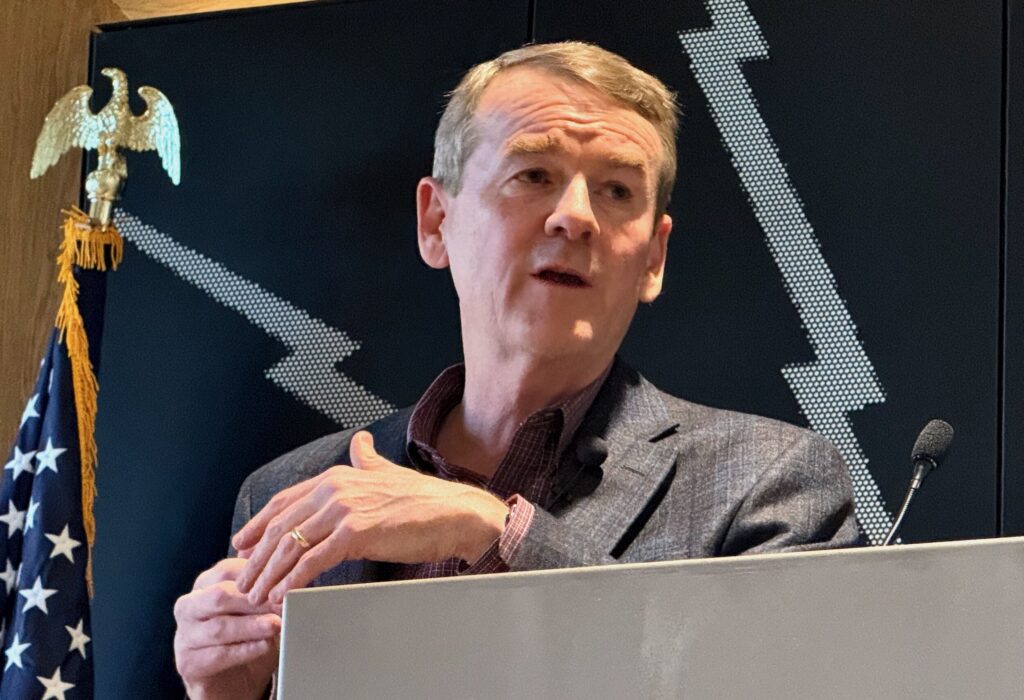

“Today, Colorado taxpayers are the winners,” Michael Fields, who leads Advance Colorado, said in a news release. “Coloradans across the political spectrum have made it clear that they need substantial and meaningful property tax relief. Today, that is what this new law delivers.”

In a statement, the governor described the compromise as the end of the “property tax wars.”

The governor’s office said the deal, combined with lawmakers also passed earlier this year, will translate into savings for residents and businesses:

-

In Denver, where the median home price is $709,920, the average savings will be $233.47 in 2025 and $259.91 in the year after

-

In Adams County, it will be $324.22 and $366.42 over those two years, respectively

-

In Garfield County, it will be $188.52 and $214.03; in Pueblo County, it will be $173.26 and $196.36; and, in El Paso County, it will be $143.30 and $160.82

However, property taxes will still go up in the next two years — they just won’t go up as much.

Proposition 108, which sought statutory changes, sought to reduce residential property assessment rates to 5.7% and non-residential (i.e. commercial) property assessment rates to 24%. The state would be required to backfill the lost property tax revenue, with one estimate pegged at $3 billion. It was certified for the ballot on Aug. 21.

Proposition 50, which sought to amend the state constitution, would impose a 4% annual cap on property tax revenues. It was certified for the ballot last October.

The Colorado General Assembly met last week to pass House Bill 24B-1001, which contains both a property tax reduction and a cap on property tax revenue.

The legislation, which draw sharp criticism from some Democrats, ultimately passed with significant support from both parties. It was one of two measures that came out of the four-day special session that ran from Aug. 26 to Aug. 29.

Lawmakers submitted a total of 13 bills, including several constitutional amendments tied to the ability of citizens to submit property tax ballot initiatives.

Only one, HCR24B-1001, cleared the House with the bare minimum 44 votes it needed, but the Senate Finance Committee quickly put an end to the proposal at the sponsor’s request, acknowledging it could not get the 24 votes in the 23-12 Democratic-dominated Senate to get to the ballot.

The compromise legislation continued the work of a bipartisan group of lawmakers who passed Senate Bill 24-233 in the 2024 legislative session. The measure sought to provide more than $3.7 billion in property tax relief over the next three years as contained in SB 233.

HB24B-1001 will require the state to backfill lost education funding from property tax reductions at about $83 million in 2024-25 and $100 million in 2025-26.

In 2025, it will cut the residential property tax rate for mill levies charged by local governments from 6.4% to 6.25% or 6.15%, depending on assessment growth. For school districts, it will reduce the mill levies from 7.15% to 7.05% or 6.95%, again depending on assessment growth.

Also in 2025, the law reduces the commercial property tax assessment rate from 29% to 27%.

HB24B-1001 extends through 2025 the state “backfill” to local governments that see cuts in revenue as required in Senate Bill 24-233, and it allows local voters to override the local government revenue cap and school districts to override the cap at the state-wide level.

And in 2026, the local government mill levy rate for residential is reduced from 6.95% to 6.8% — 6.7% depending on assessment growth. With the added provision in SB 233 that reduced the valuation by 10% of the first $700,000 of property value for tax liability purposes, the assessment rate is much closer to the 2025 levels.

Commercial rates will drop to 26%. After 2026, the rates for residential properties will remain at that 2026 level; nonresidential will drop to 25% and hold at that level.