Americans for Prosperity: State retirement plan is ‘out of date’ — to say the least

Anyone recall the ’60s war spoof, “Situation Hopeless…But Not Serious”? To the various critics of the Colorado Public Employees’ Retirement Association, or PERA, the movie’s title must seem apt: They’d argue the system faces a looming crisis that nobody at PERA itself seems particularly worried about.

The concern is often raised by the political right – Republican Treasurer and gubernatorial hopeful Walker Stapleton has made it a veritable crusade – and they point to teetering state pension systems around the country as writing on the wall.

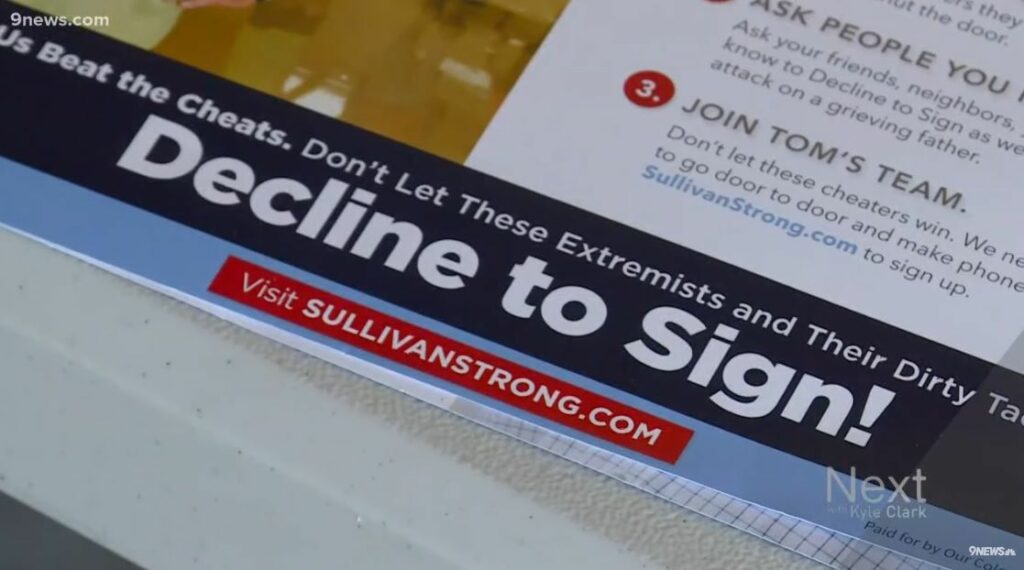

This week, one of the right’s most prominent players, Americans for Prosperity-Colorado, debuted a new education campaign to alert the public to what AFP says are PERA’s impending perils for taxpayers. Sweeping, structural changes are needed, AFP maintains, and as the group makes clear in a key campaign catchphrase – “PERA is a disaster in the making” – reform can’t come too soon. From the campaign’s new website:

Colorado’s public pension system is in serious trouble. The Public Employees’ Retirement Association (PERA) is underfunded by tens of billions of dollars and getting worse every day. Unless Colorado takes steps to fix the problem, retirees will see their pension promises broken, and taxpayers could be forced to pick up the tab for spiraling pension costs. At the same time tax dollars would likely be diverted away from classrooms, infrastructure, and public safety to pay for pensions.

PERA’s “defined benefit” system, funded by payroll deductions from state employees and public schoolteachers, guarantees retirees a fixed monthly payment based on how much they were paid during their working years. Kind of like the federal government’s Social Security system. How did PERA get in such a jam? AFP contends:

While defined benefit plans are generally more expensive, states could choose to fund them fully by guaranteeing the full actually required contribution (ARC) payments each and every year.

Unfortunately, politicians would rather spend that money on projects today, often leaving pensions woefully underfunded.

To make matters worse, Colorado’s legislature passed a law that has allowed them to chronically underfund PERA for over a decade. This has caused PERA’s unfunded liabilities and costs to taxpayers to both skyrocket.

And there’s this dire warning:

To make ends meet, states will have to raise taxes, while cutting funding for core functions of government such as schools, public safety and infrastructure.

What’s to be done? Though the website doesn’t spell it out in so many words, AFP seems to prefer a 401K-style “defined contribution” plan, common to the private sector. The payout to retirees could be great or not, depending on how the fund is invested over time as well as on how financial markets are performing overall. AFP lays it out like this:

Colorado implemented some minor reforms in 2010, but PERA is still headed toward disaster. Colorado needs to change its out-of-date retirement system and move to a model that is seen in the private sector. This will not only give employees portability and flexibility in their retirement, but also lessen the burden on taxpayers.

The advocacy group also urges site visitors to sign a petition urging lawmakers “to update Colorado’s pension system and give public employees more control over their own retirement while protecting taxpayers and current retirees.”

OK. What does PERA say? We asked system spokeswoman Katie Kaufmanis, who responded thusly:

The assertion that Colorado’s retirement system can be reformed by simply changing it from a hybrid defined benefit plan to a defined contribution (401(k)-type) plan ignores the following facts:

In July 2015, the Colorado General Assembly’s Legislative Audit Committee released a report determining that the cost to fund PERA benefits is lower than the cost of other plans in the public and private sector. Independent actuarial firm Gabriel, Roeder, Smith & Company (GRS), with oversight from the Office of the State Auditor, examined the plan design of Colorado PERA and released the report. The report also found that when costs are held constant, PERA’s Hybrid Defined Benefit Plan delivers the highest percentage of salary replacement income in retirement – for short-term as well as career public employees in Colorado.

National research finds that public sector employees with retirement plan choice overwhelming choose defined benefit (DB) pension plans over 401(k)-type defined contribution (DC) individual accounts.

States that have switched to defined contribution plans for their public employees have experienced higher costs. (Alaska, Michigan, West Virginia case studies here.)

The PERA Board of Trustees has worked to develop a legislative recommendation for the Colorado General Assembly that reduces the time it will take PERA to become fully funded. This package includes benefit reductions and contribution increases and is projected to return PERA to full funding in 30 years.

This is of course an old debate that isn’t going away anytime soon. Thanks to AFP for the brush-up on the issue, and thanks to Kaufmanis for weighing in, as well.